Product OverviewUnlock your bank’s potential

Build a complete, modern financial ecosystem on a single, powerful platform. Launch market-leading propositions with unmatched speed and flexibility using Engine’s full suite of configurable products.

ProductsBuilt to scale

Benefit from our comprehensive product set and roadmap as we scale, together. Our pre-integrated, globally proven solutions manage the complexity, so you can focus on your customers.

Products

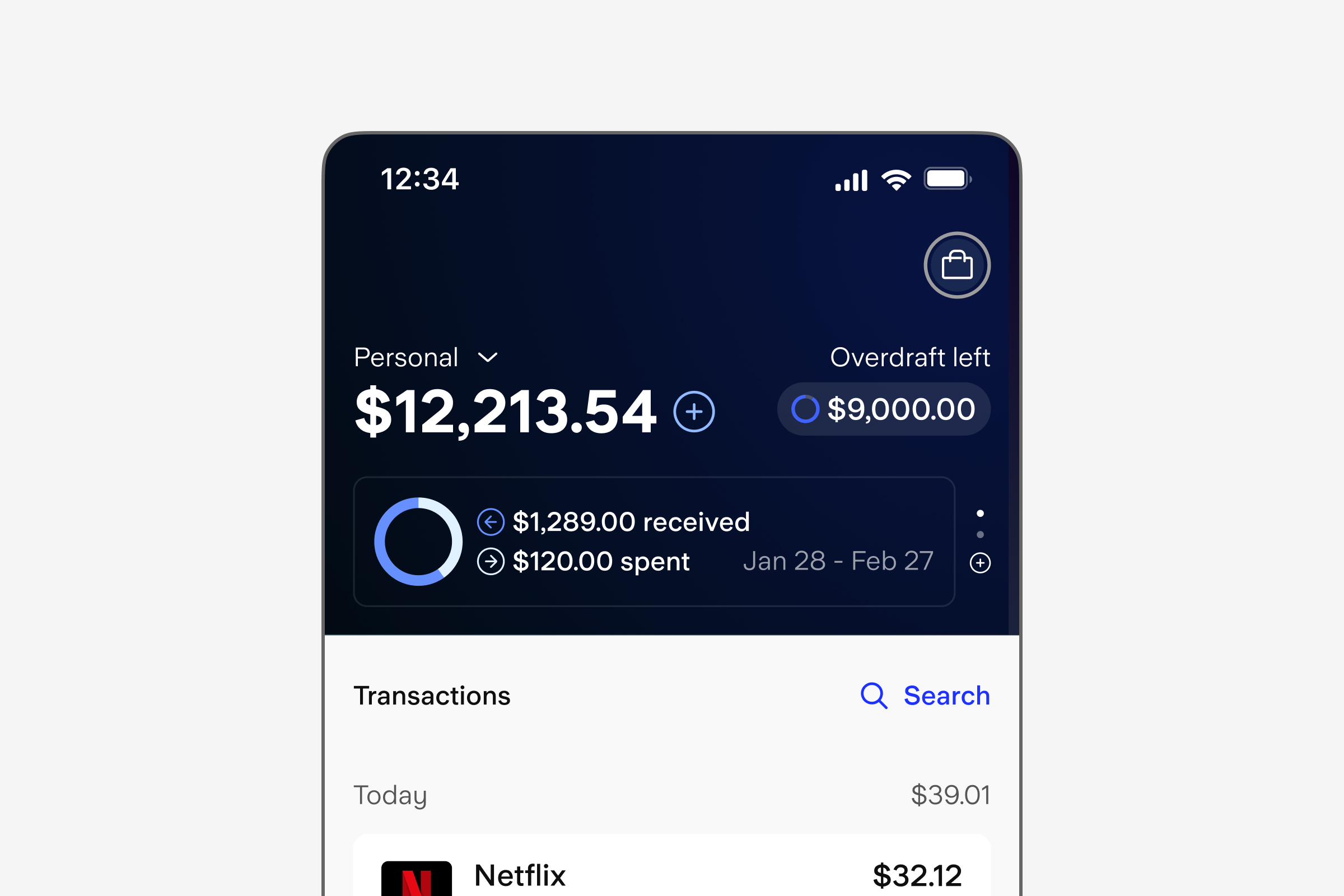

Launch dedicated transaction accounts designed for the unique needs of retail and business customers, complete with seamless digital onboarding to provide an exceptional experience from day one.

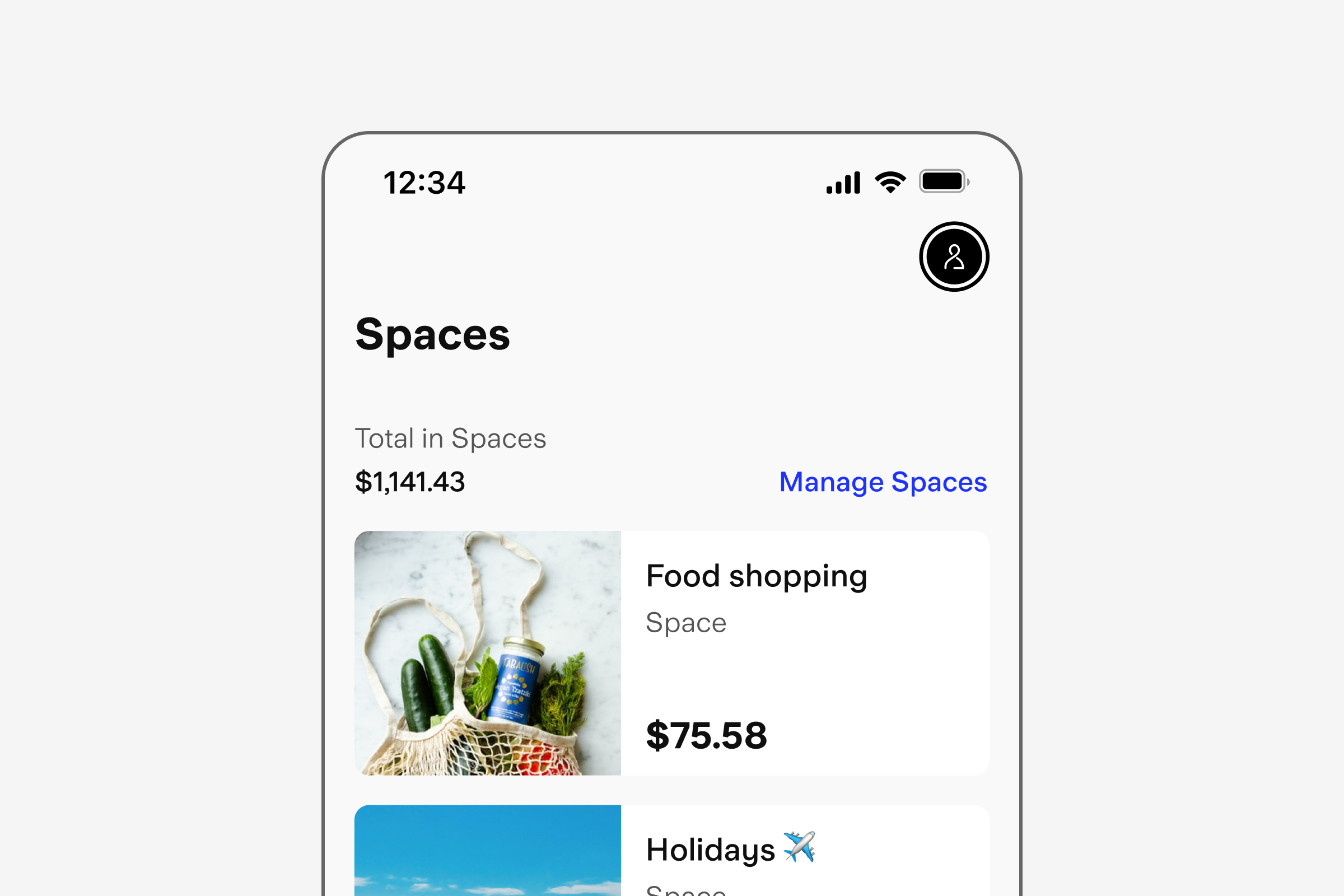

Capture deposits and deepen customer relationships with a complete suite of modern savings products. Support customers aiming to save money over time and achieve their financial goals.

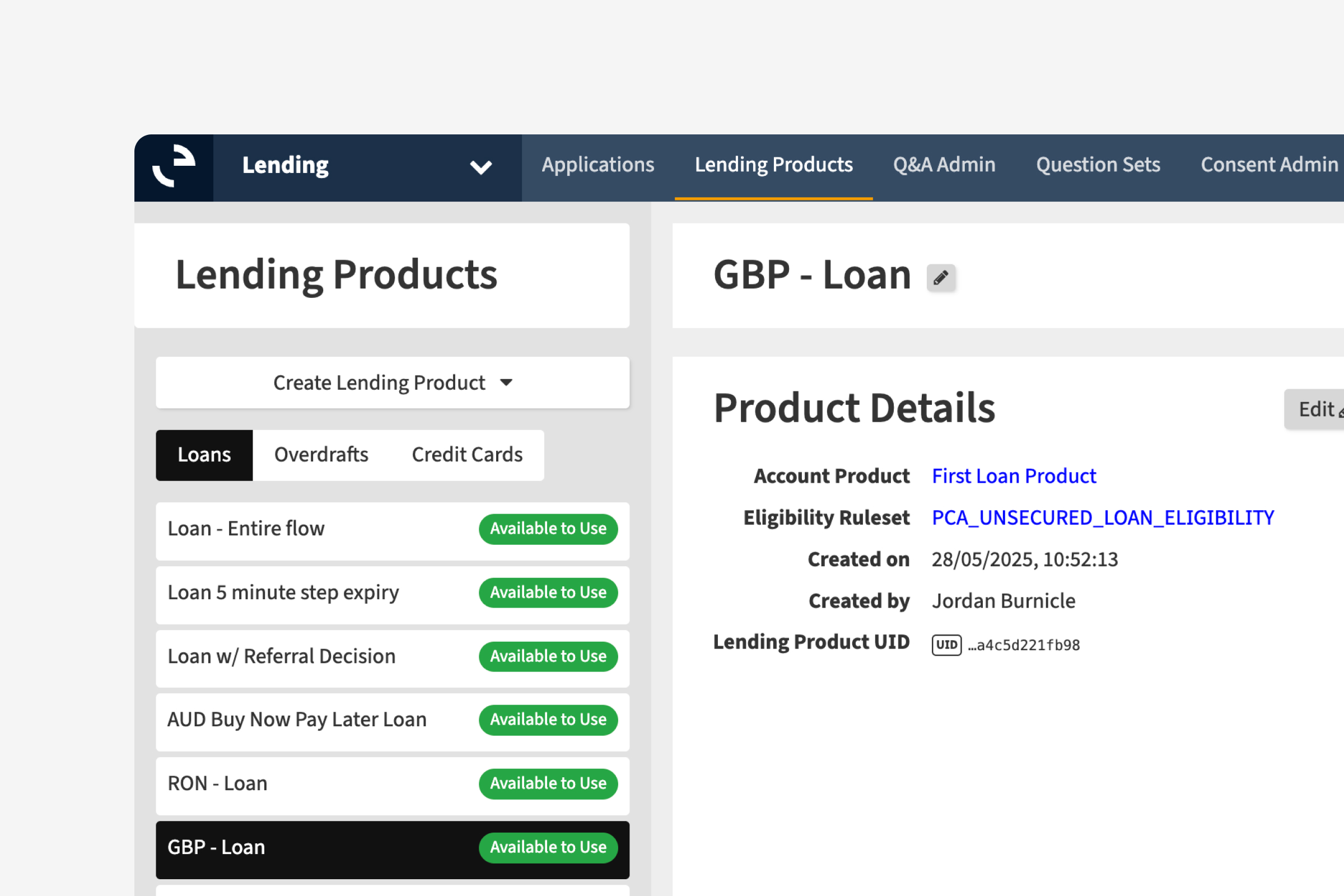

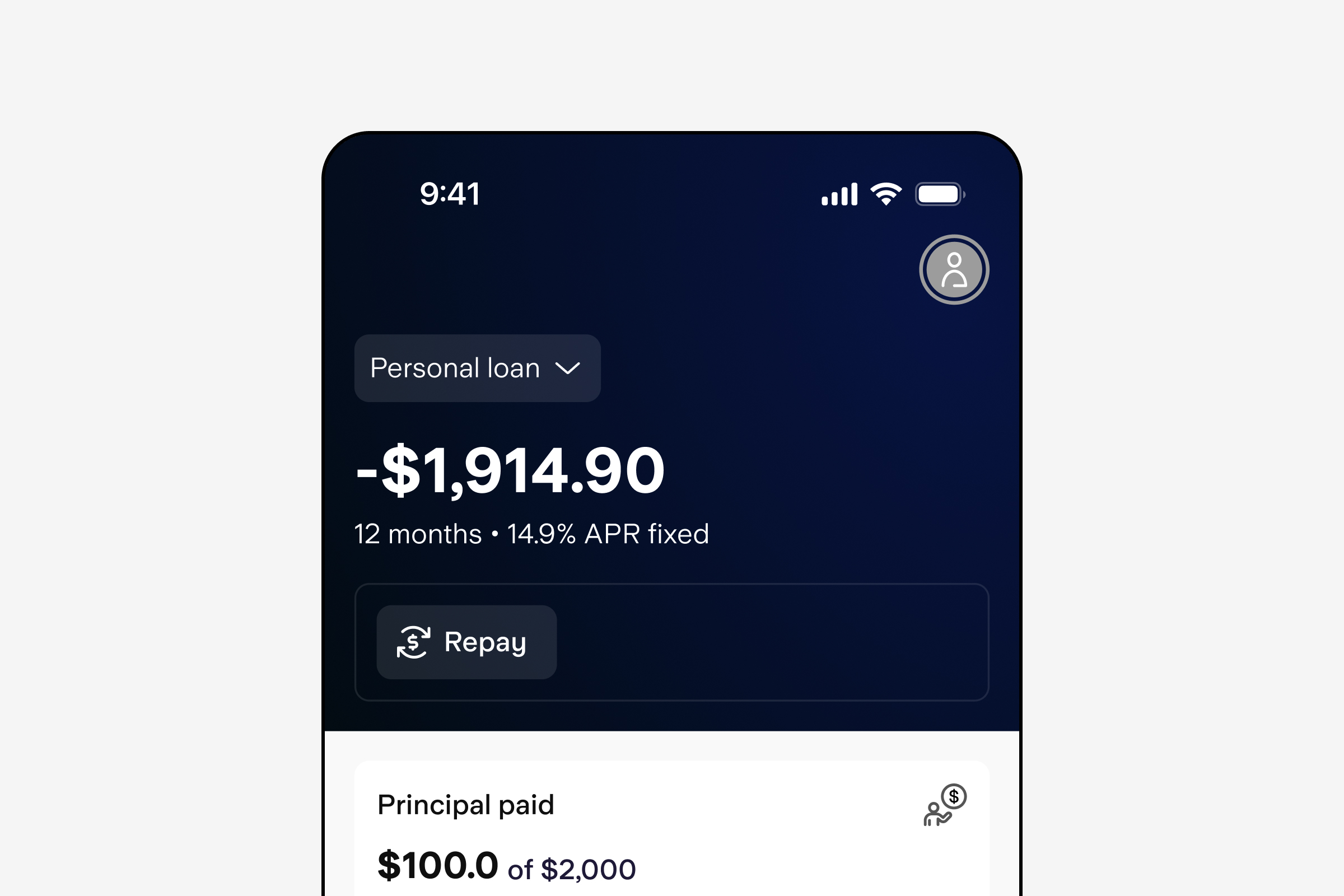

Accelerate your time-to-market for lending with our highly-configurable loans capability. Rapidly configure and launch secured and unsecured loan products, for both retail and business customers.

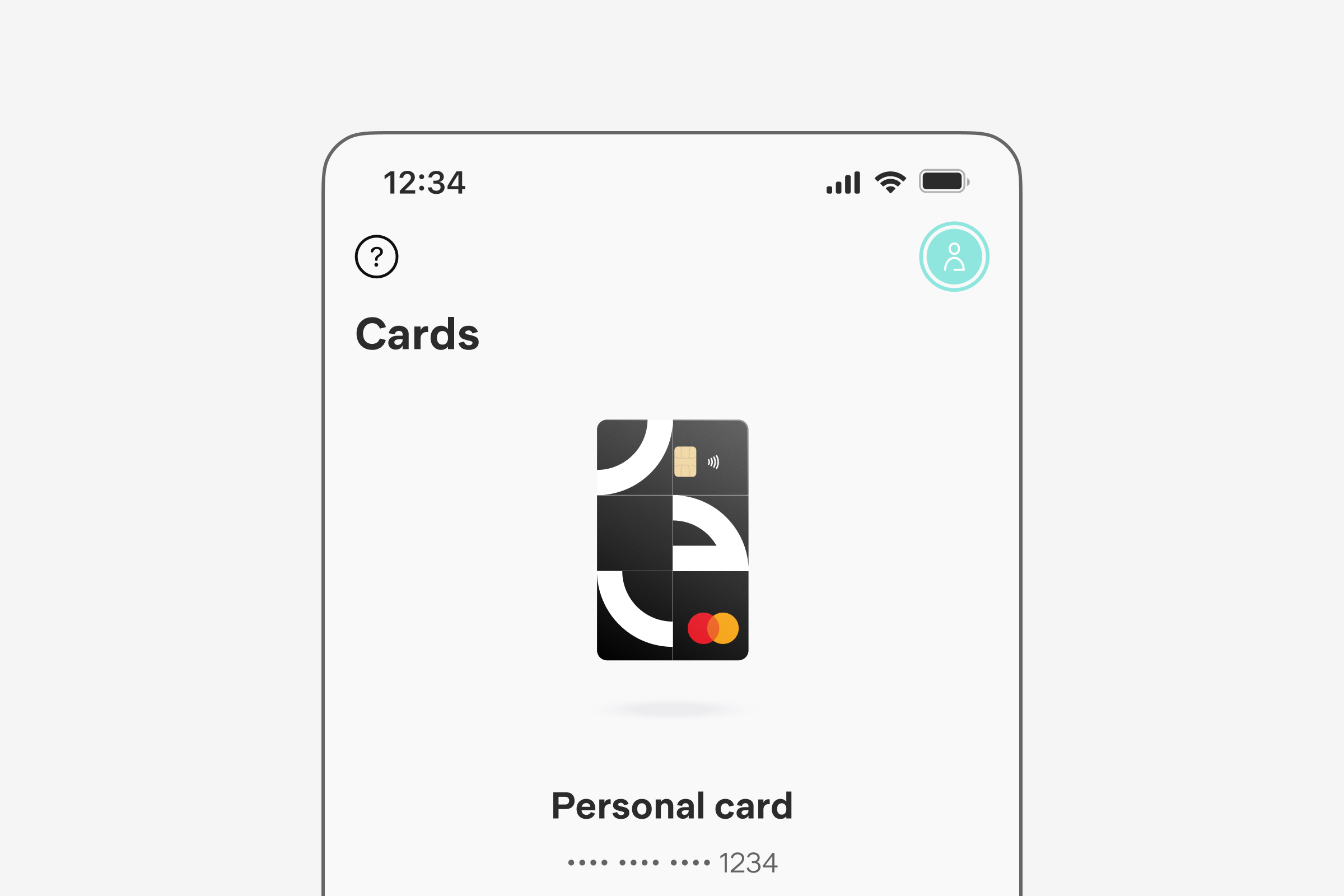

Create and launch market-leading credit card offerings for your retail and business customers. Use Engine’s modular, configurable customer application journeys to offer rich and flexible credit options.

Give customers the security of a financial safety net. Engine’s overdraft functionality gives your customers the breathing room needed to smoothly navigate life's unexpected moments.

Contact UsWant to learn more?

Whether you’re launching a new digital bank, migrating from a legacy platform, or launching a sidecar proposition, Engine can help you achieve success. Share details about your requirements and we will be in touch.