10 key takeaways: Core modernisation decoded

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

Engine by Starling

All the capabilities needed to run a competitive, cost-effective digital bank

Much more than a core

Whether you’re already a bank, you’re launching one, or you’re a corporate looking to offer a banking product: Engine’s modular cloud banking platform provides almost everything you need for digital-first banking.

And because Engine powers Starling, we’re committed to ensuring these capabilities are constantly upgraded and improved without disruptions or risk to your ongoing operations. You’ll get access to our innovation roadmap, with continual improvements to products, features and infrastructure.

Banking Capabilities

Here’s a quick overview of the banking capabilities you can access through Engine. If you’d like to know more, our team are on hand to help with a product demo.

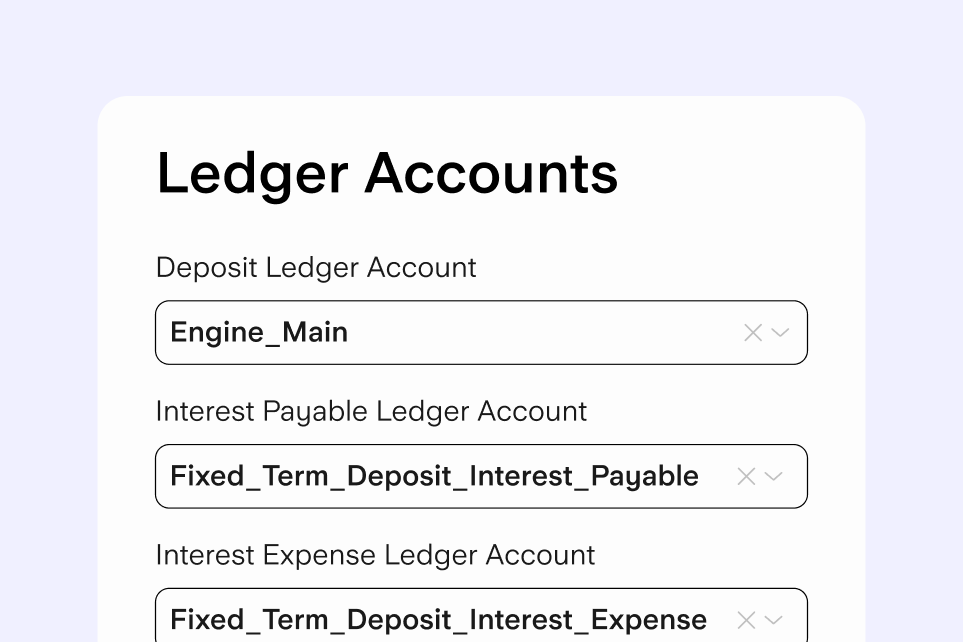

Engine modernises ledger capabilities, ensuring you can track customer accounts, balances, and key events.

Engine provides a range of payments functionalities – some essential, others innovative, but all designed to make banking better than it’s ever been before for your customers.

Along with automated rules-based capabilities, onboarding teams can handle every step of the process – helping your business grow and ensuring rigorous verification and risk procedures are in place.

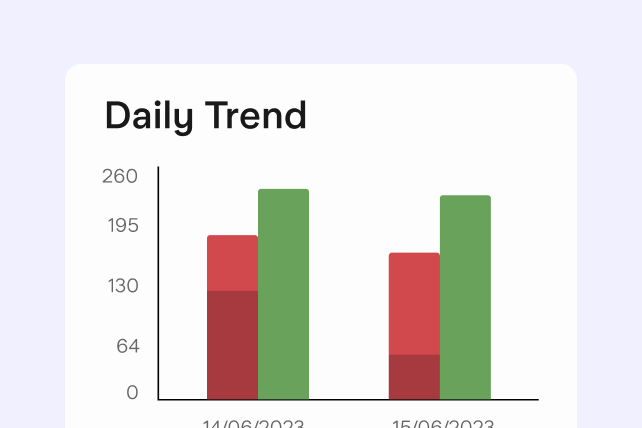

Engine has a range of capabilities to help you identify, tackle and block financial crime, whether that’s alerting customers to risks or setting up event monitoring.

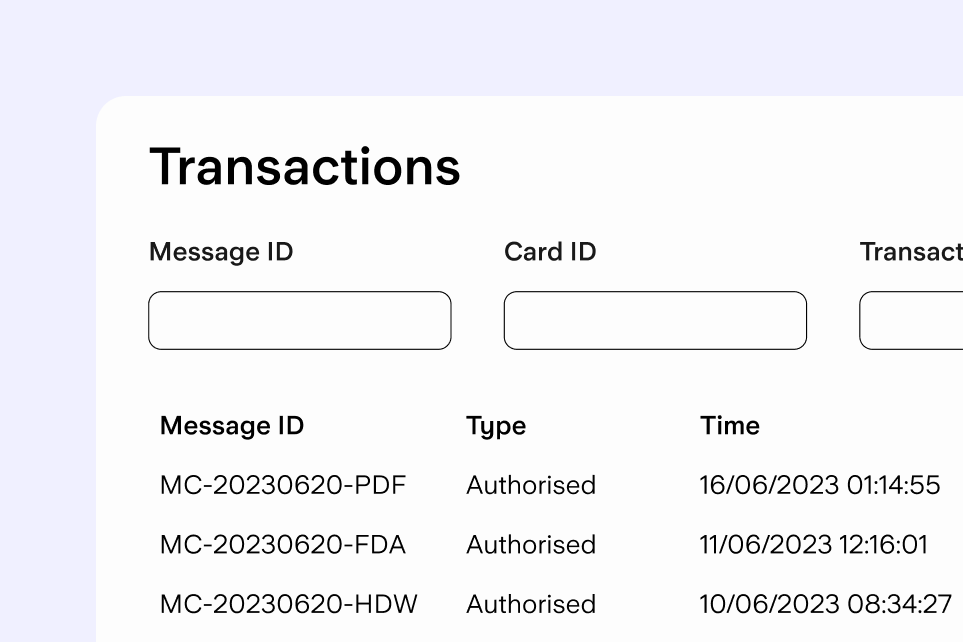

Engine comes complete with a card processor, an accredited solution currently supporting millions of transactions every day.

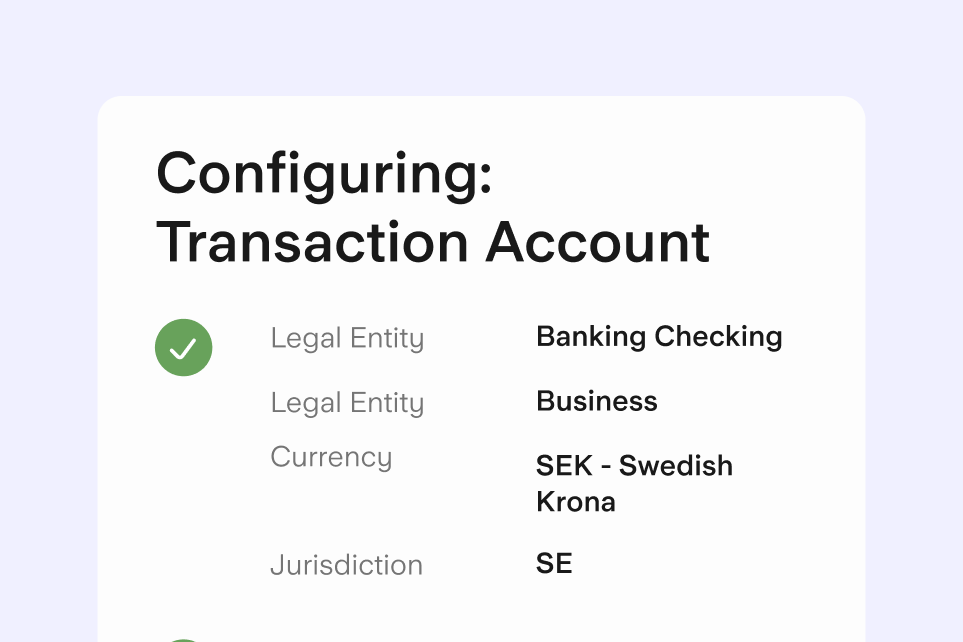

Engine offers pre-configured products, but we know you’ll want your own unique propositions – so you can fine-tune products in Management Portal.

Build, launch, and continuously improve new digital products for personal and business banking.

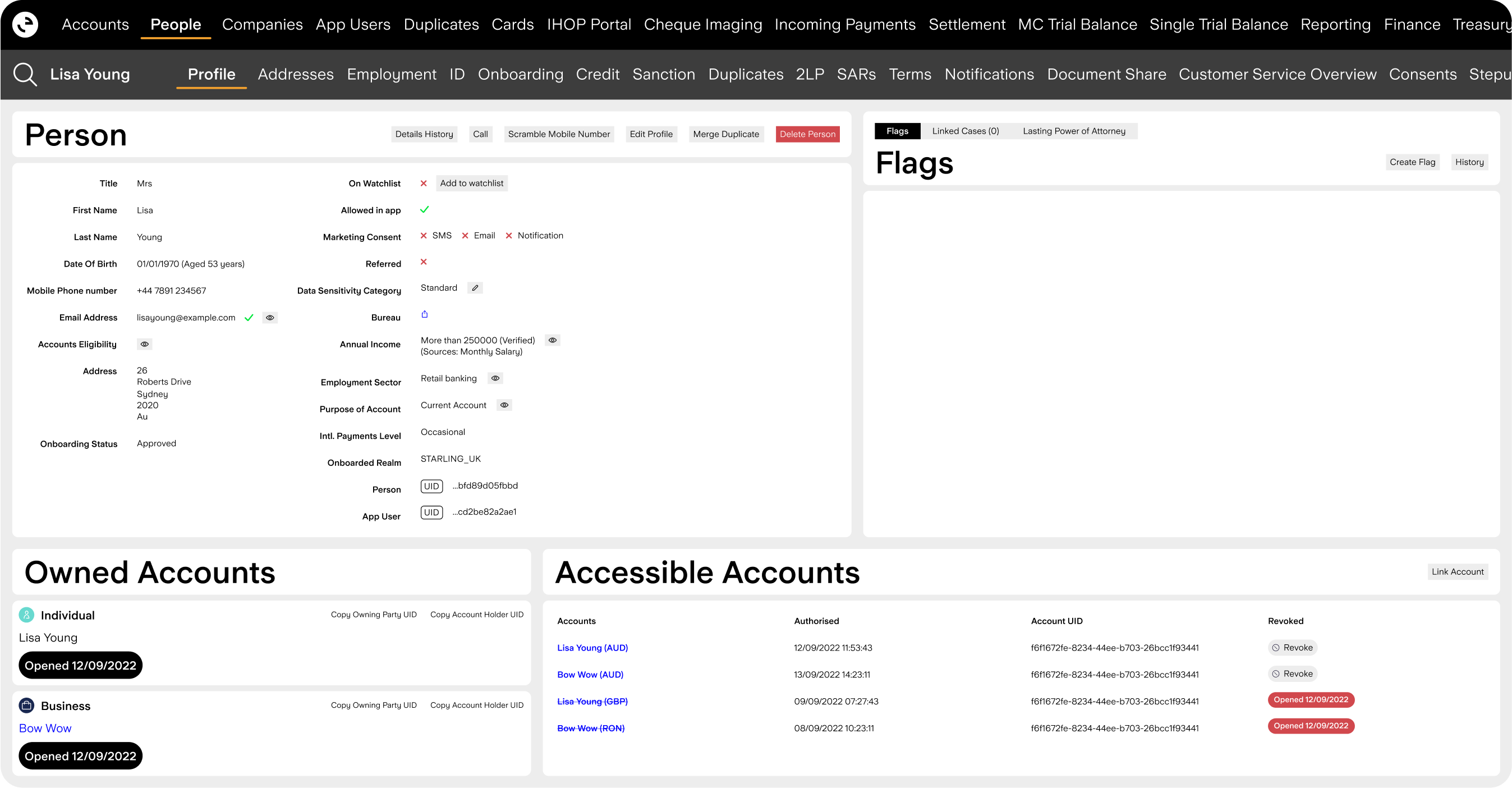

Learn moreThe processes and tools your employees need to deliver truly industry-leading operational support and customer service, all wrapped up in one single place: Management Portal.

Learn moreDigital-first, human always

We’re proud to offer a wide range of innovative banking capabilities. But we’re not just about helping you build exceptional products – we’re also committed to ensuring your people can manage their tasks effectively.

Management Portal is a browser-based interface that your employees can use to access the functionality provided in Engine. Think of it as a single pane of glass that gives you a holistic view of your customers and processes. (Say goodbye to switching between endless different systems!)

It’s intuitive, clear, and cohesive – and you’ll have full control over access management for different users and teams, including but not limited to:

Engine by Starling

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

AMP wants to transform the local business and personal banking market by giving Australian customers the digital banking experiences they’ve long deserved.

Engine has been recognised as a Challenger in the 2025 Gartner Magic Quadrant for Retail Core Banking Systems, Europe.