10 key takeaways: Core modernisation decoded

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

Why Engine?

A platform built by banking experts

Engine by Starling

On a platform proven to deliver.

As the world’s banks and financial institutions strive to modernise and launch digitally-native products, one thing is abundantly clear. Transformation is vital – but also complicated, not to mention risky and expensive. To get it right, you need a partner with first-hand experience of digital banking, and a proven plan for derisking the journey.

Engine is that partner. We know what it takes to run a highly competitive and cost-efficient bank, and our platform provides the capabilities to offer new, fully developed products that delight customers.

Who is Engine for?

Whether you need to derisk the process of moving from legacy architecture or need help bringing innovative banking products to market, we’ve got the right combination of technological excellence and experienced people to make your project a success.

Get started001

Bring a new digital bank to life on the same platform that powers the UK’s Best Current Account.

002

Easily configure innovative financial products on our cloud-native, API-first platform.

003

Weighed down by legacy systems? Migrate to Engine to reach your full innovation potential.

Partners

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 151 countries with over 364,000 people who are committed to delivering quality in assurance, advisory and tax services.

Read more

Deloitte is the largest professional services organisation in the world with a network spanning 150 countries and territories, and powered by 450,000 professionals. We provide audit and assurance, tax and legal, consulting, risk advisory and financial advisory services to a broad cross-section of the largest corporations and governmental agencies around the world.

Read more

GFT Technologies is an AI-centric global digital transformation company. We design advanced data and AI business transformation solutions, modernize technology architectures and develop next-generation core systems for industry leaders in Banking, Insurance, Manufacturing and Robotics. Partnering closely with our clients, we push boundaries to unlock their full potential. Our team of 12,000+ technology experts operate in 20+ countries worldwide offering career opportunities at the forefront of software innovation.

Read more

Publicis Sapient empowers organisations to transform through the power of digital. As a leading transformation partner, we help businesses unlock value by fusing strategy, consulting and customer experience with agile engineering and problem-solving creativity. The result? Products and services their customers love.

Read more

At Xebia we create digital leaders and build resilient organisations at any scale. We are a global technology consulting and services company with over 6,000 experts worldwide. Our banking domain expertise makes us uniquely positioned to deliver transformative solutions that drive sustainable growth and success for our clients worldwide.

Read more

Ozone API empowers banks and financial institutions to adapt and thrive in the new world of open data, by providing the API technology to unlock the power of open finance and change the world. The UK-based fintech provides the leading standards-based open API platform, supporting all global standards and providing the tools and expertise to help banks and financial institutions create real commercial value.

Read more

Engine is a Mastercard Network Enablement Partner. Engine makes it simple for partners and customers to collaborate with Mastercard and accelerate time to market for product innovation through access to Mastercard’s global network, expertise, technology and resources.

Read moreEngine’s benefits

We’re the people behind the platform that powers the four-time winner of Britain’s Best Bank. So we know what it takes to run a digitally native bank successfully. From a tech perspective, Engine offers everything you need to innovate rapidly and transform your operations. Meanwhile, our fast-growing team includes some of the brightest minds in banking – all of whom are driven to use technology to transform banking for the better. Here’s how we help you do it.

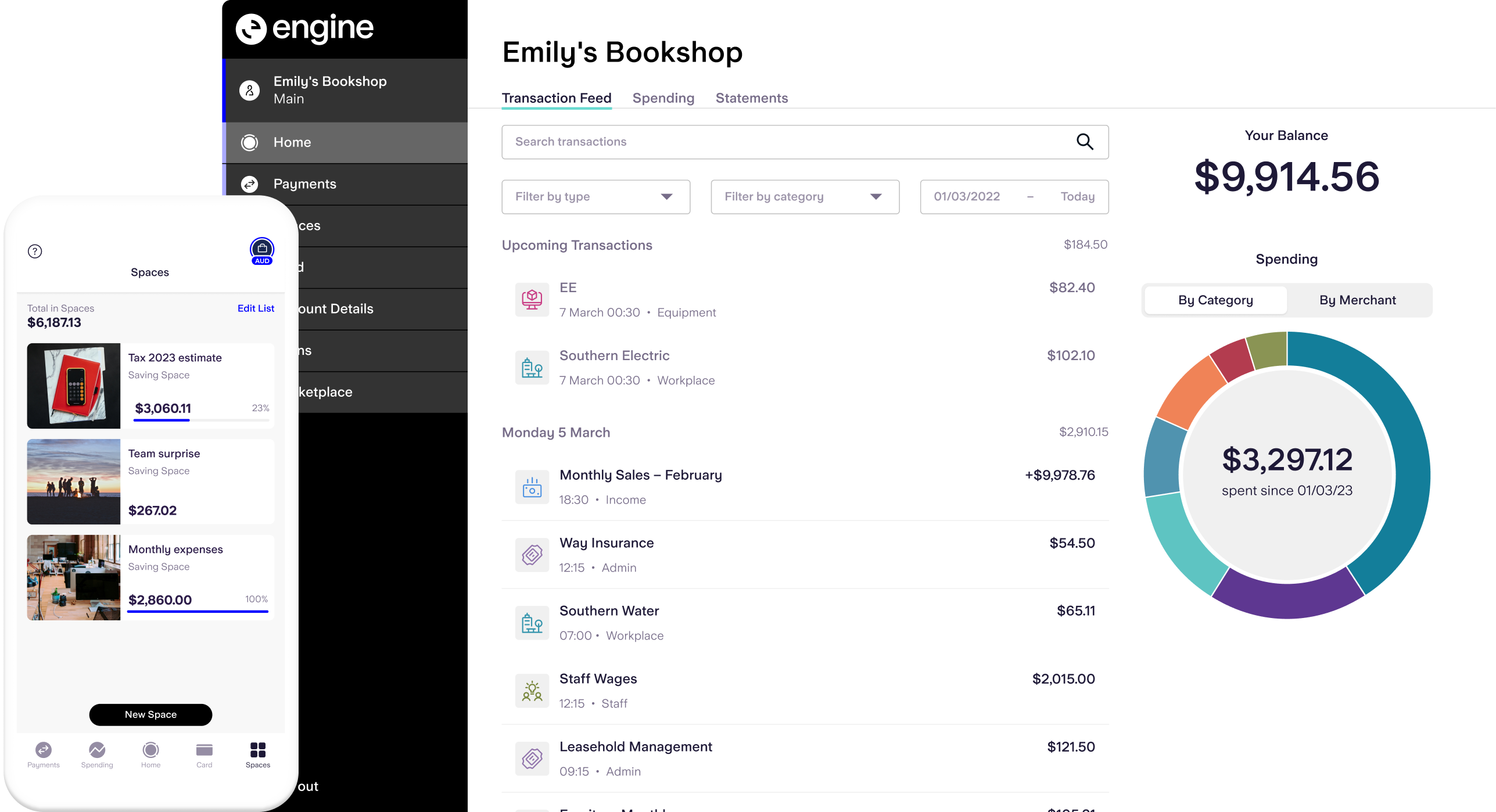

Get startedEngine is your one-stop solution for banking excellence. It goes far beyond the basics of core banking, offering everything from a built-in Contact Centre to a card processor, plus comprehensive frameworks, workflows and insights. It’s a complete working solution that you can configure and manage for every aspect of digital banking, reducing the implementation workload significantly. And because our tech is already proven to deliver, we derisk transformation, guaranteeing faster time to market, smoother implementation, and cost savings.

Engine by Starling

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

AMP wants to transform the local business and personal banking market by giving Australian customers the digital banking experiences they’ve long deserved.

Engine has been recognised as a Challenger in the 2025 Gartner Magic Quadrant for Retail Core Banking Systems, Europe.