ProductOverdrafts

Offer your customers arranged and unarranged overdrafts to provide an intelligent financial safety net, pre-approved and ready when they need it. Engine’s overdraft functionality is designed to support customers through the unexpected, from an urgent repair to a temporary gap between payments.

OverdraftsGive your customers a reliable safety net

Engine’s overdraft functionality is designed to support customers through the unexpected, from an urgent repair to a temporary gap between payments.

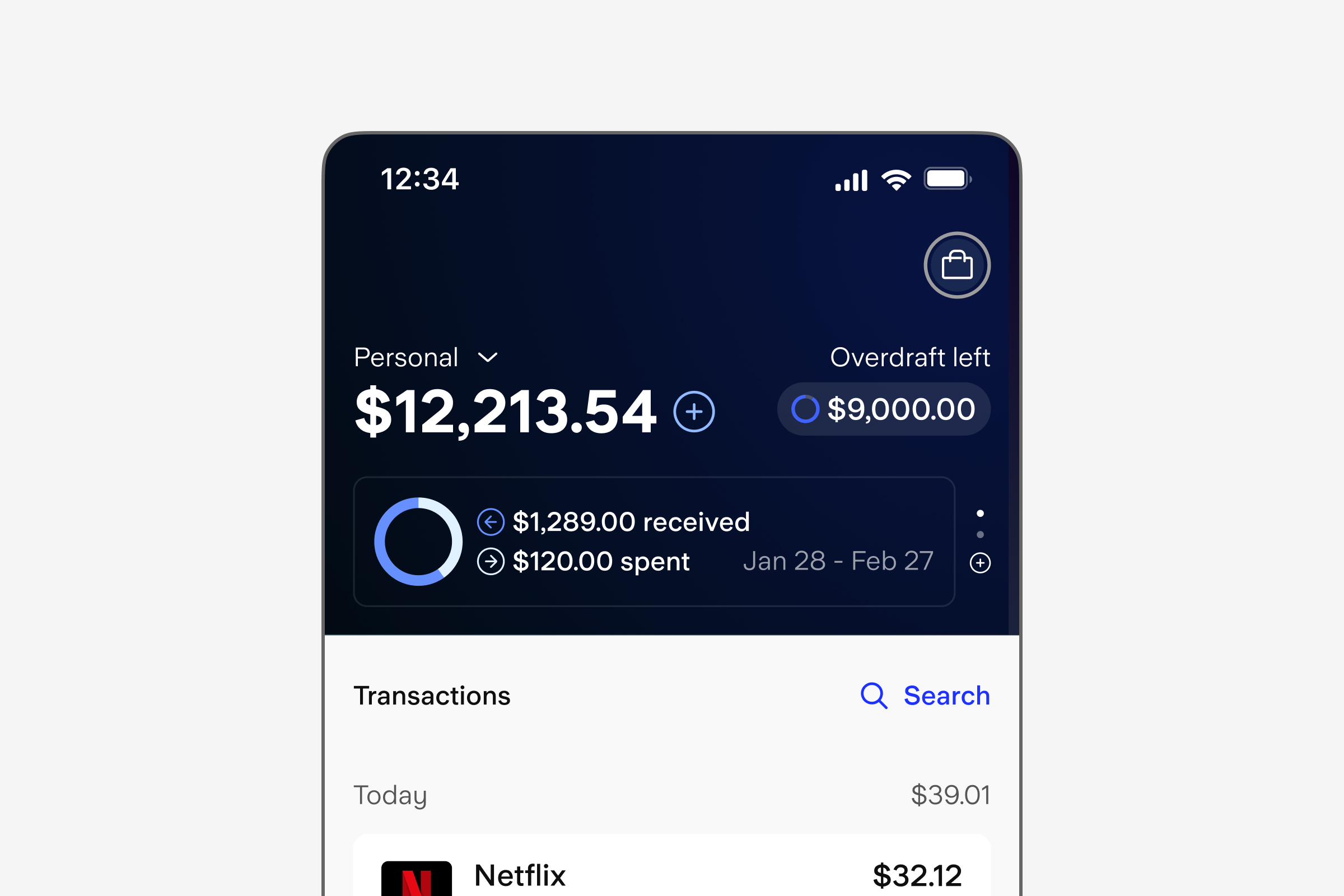

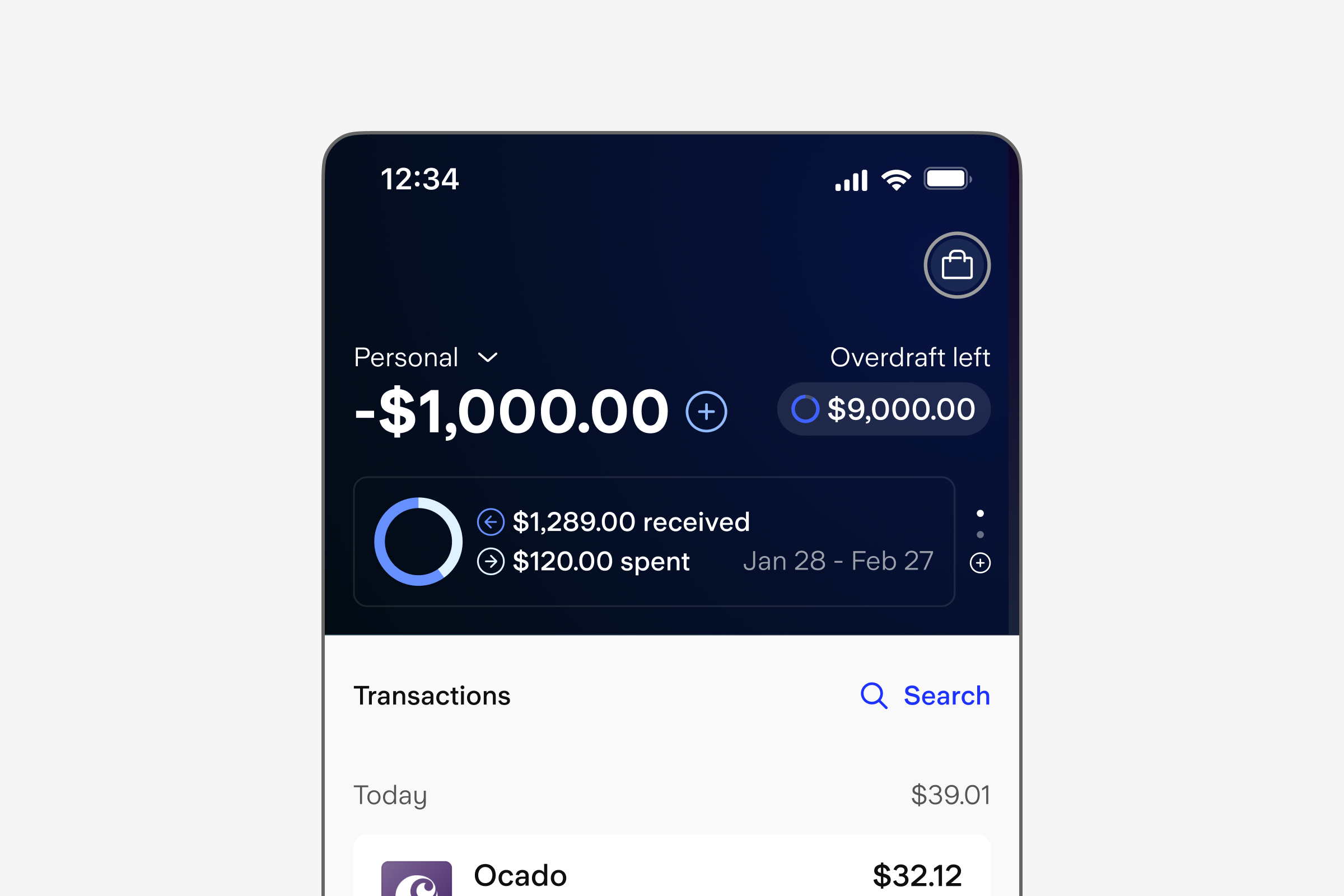

Your customers can easily view their overdraft balance, and how much they have used, in their app. Empower customers to autonomously manage their finances by setting an overdraft cap.

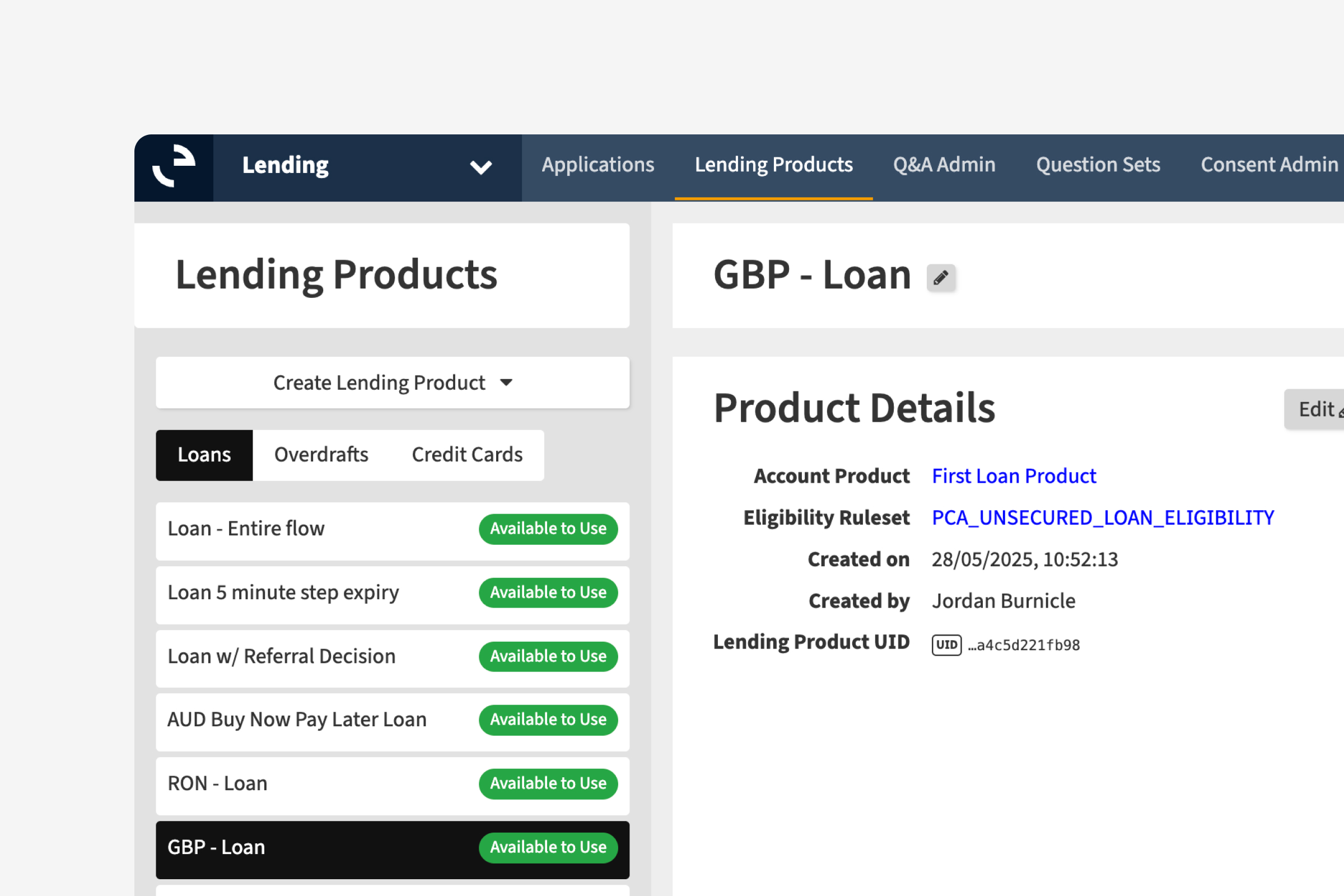

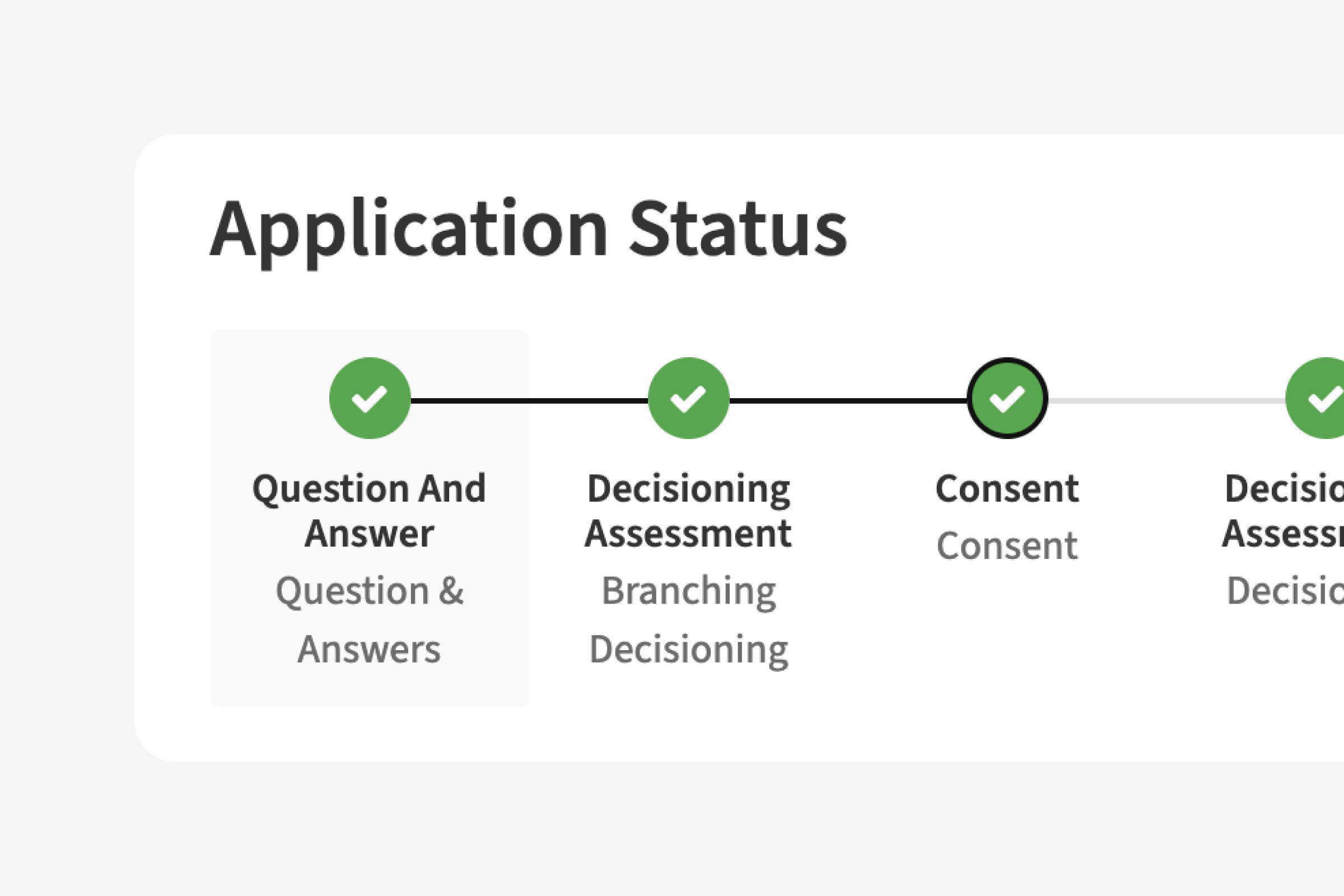

Employees have full visibility over customer applications and in-life overdrafts. Customer eligibility information is easily surfaced to make decision making highly efficient, and comprehensive dashboards provide essential metrics.

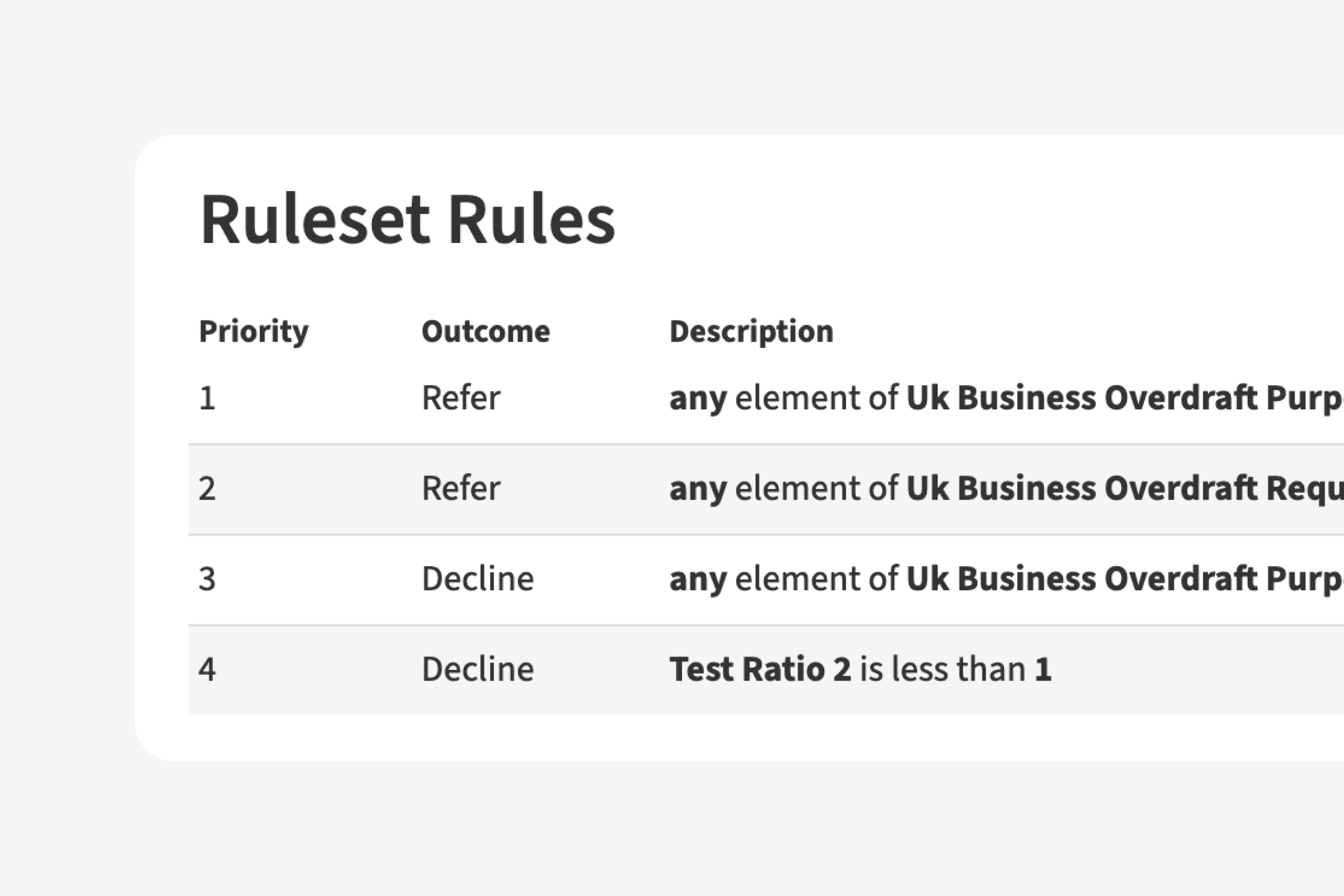

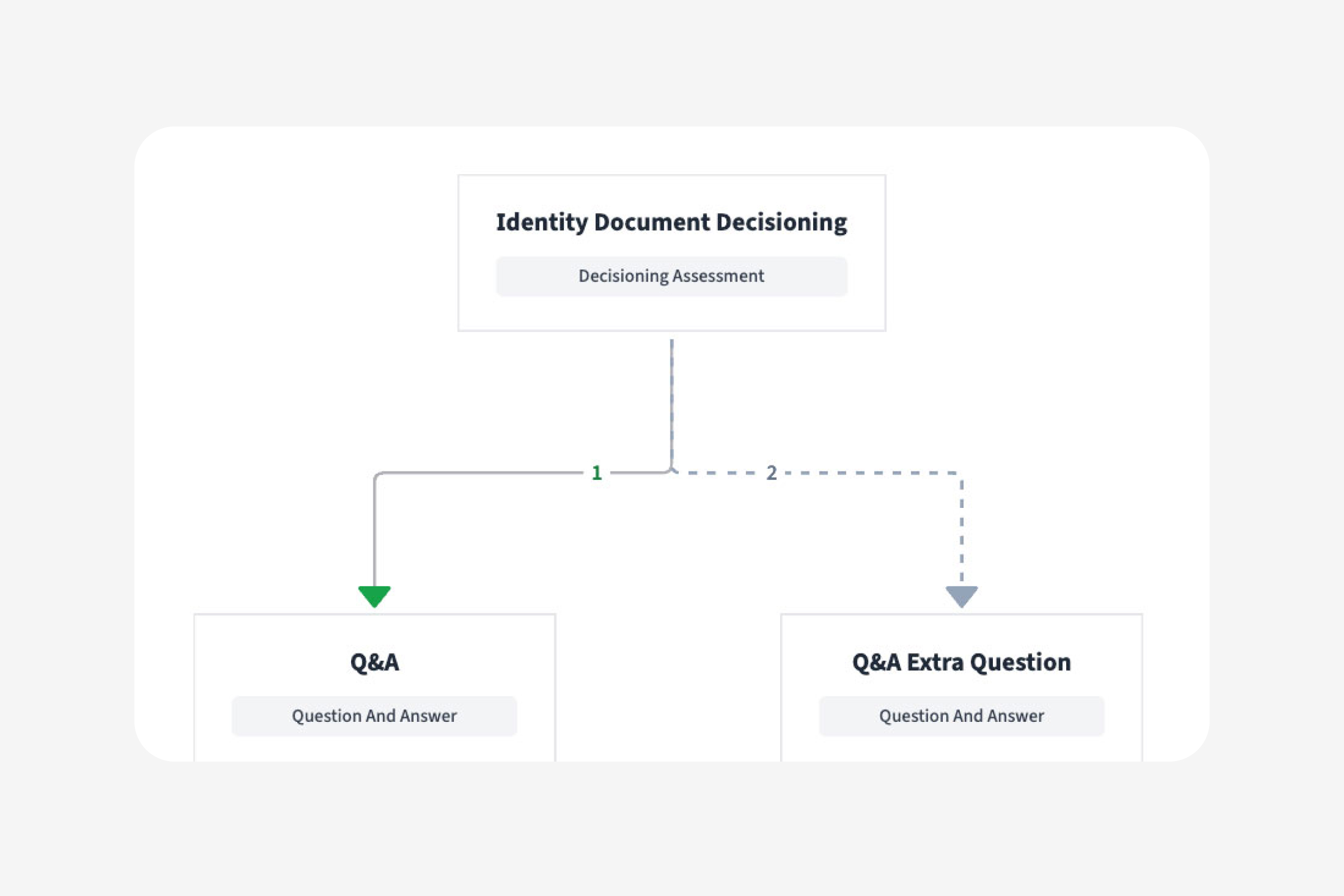

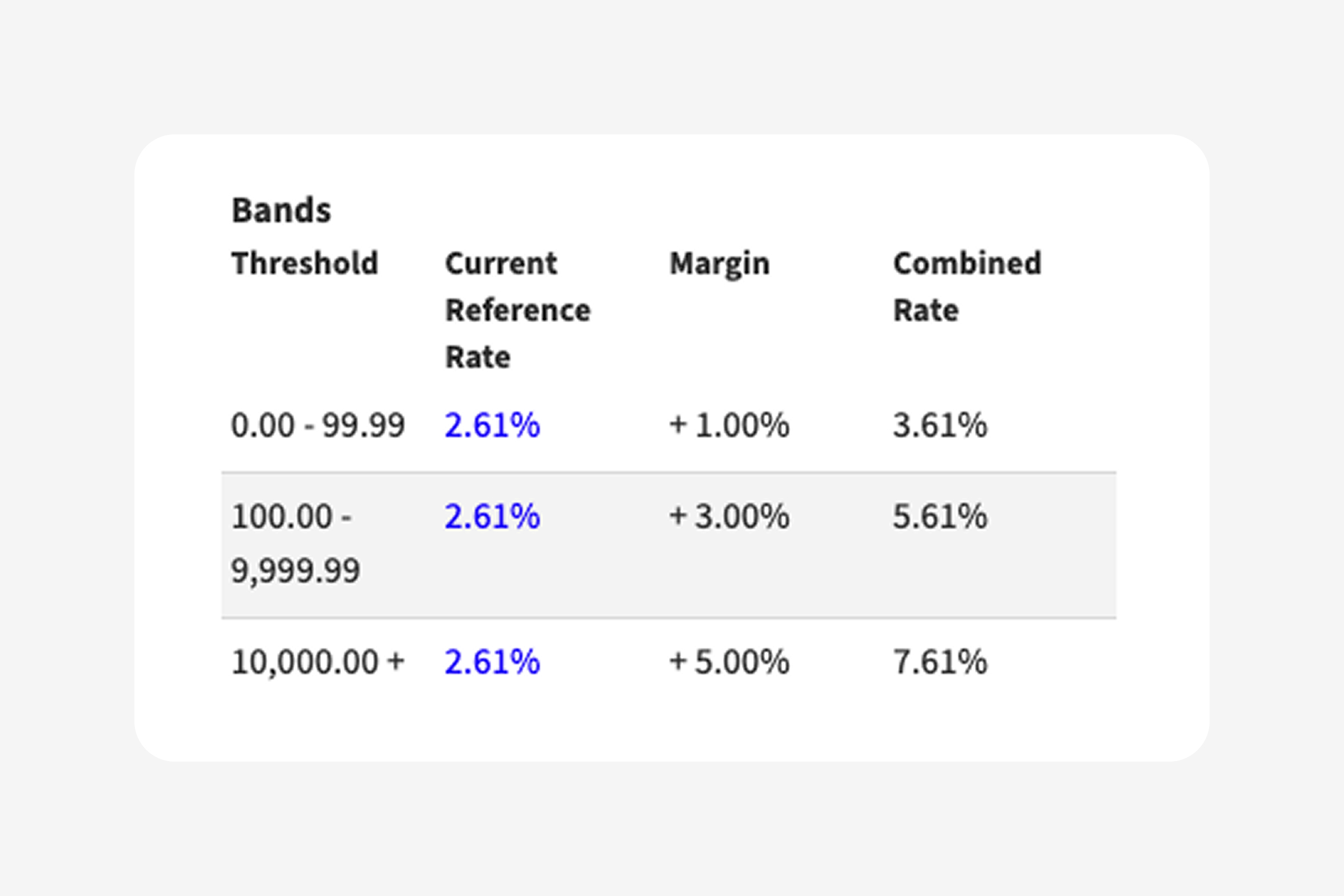

Configure interest rate schemes to assign to your overdraft products, allowing different rates to be applied to different groups of customers. Utilise Engine’s modular, flexible lending journeys to craft an overdraft offering perfect for your customers.

Empower your lending teams with configurable application flows, including the addition of steps based on customer data.

Configure multiple interest rates for the same overdraft product, with the functionality to assign multiple tiers to each interest rate.

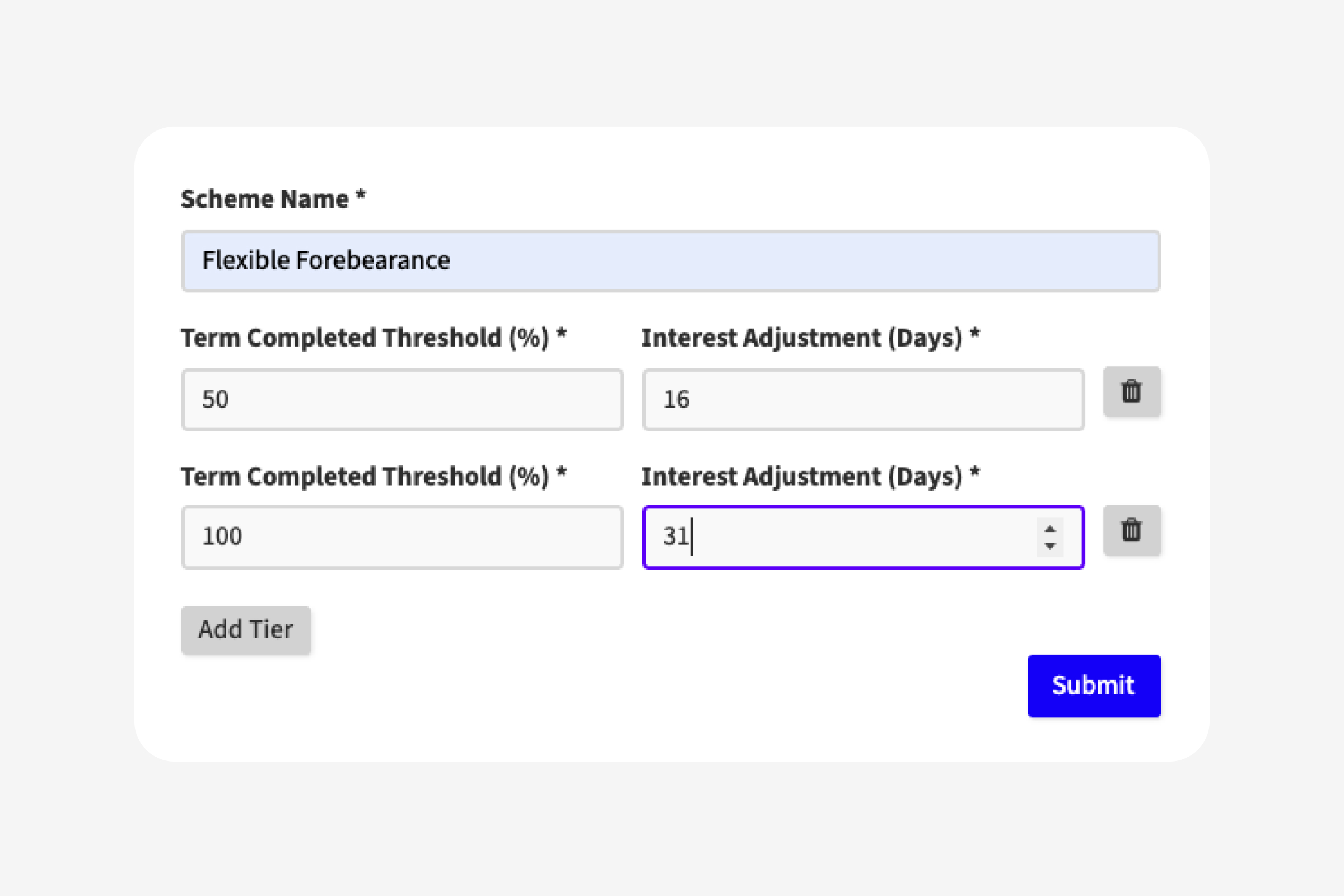

Allow customers in financial difficulty to utilise a forbearance interest rate or a scheduled payment plan to repay their balance.