ProductSecured & Unsecured Lending

Empower your teams with automated workflows for efficient decisioning. Grow your lending book with superior speed and operational control. Rapidly configure and launch loan products, for your retail and business customers.

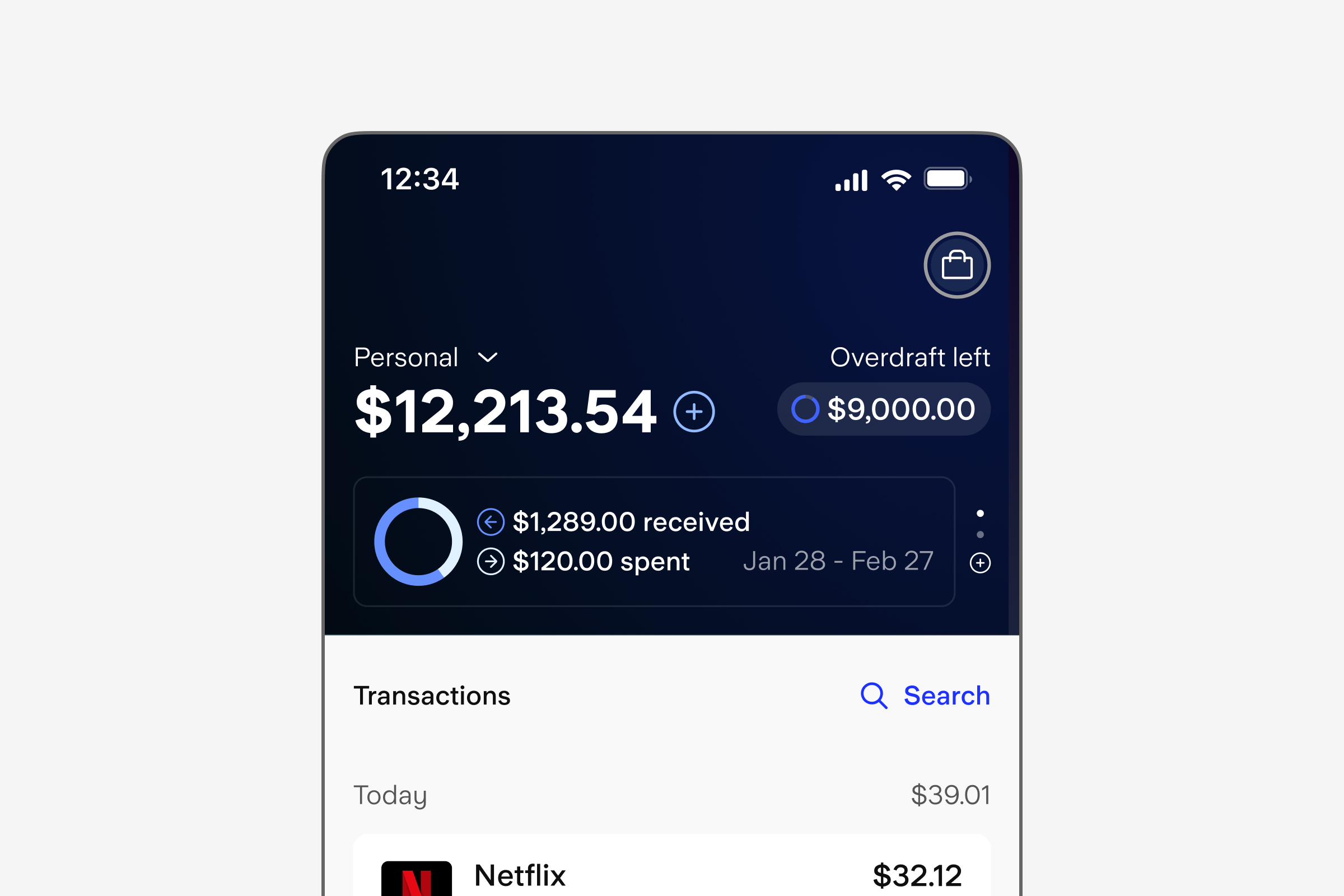

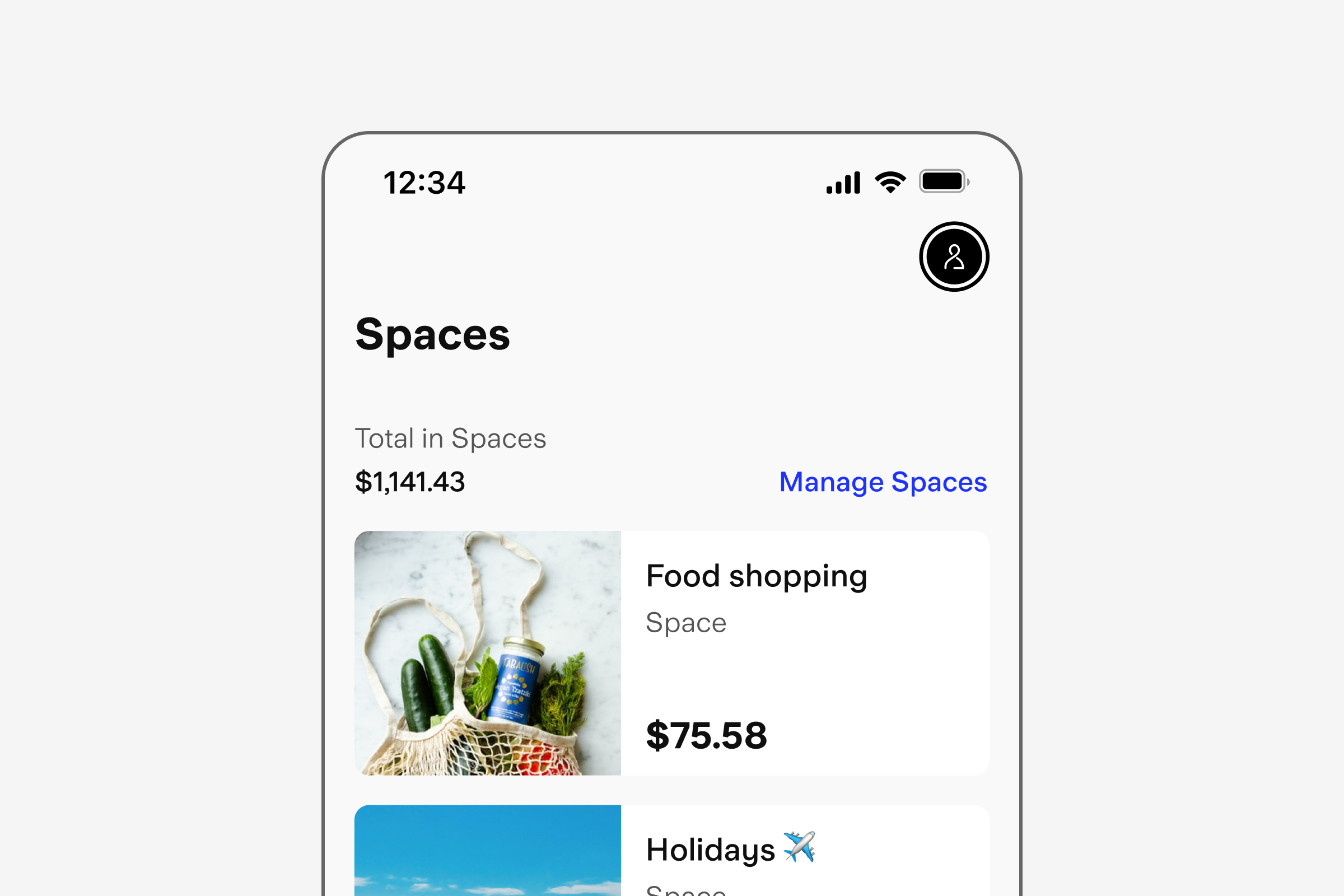

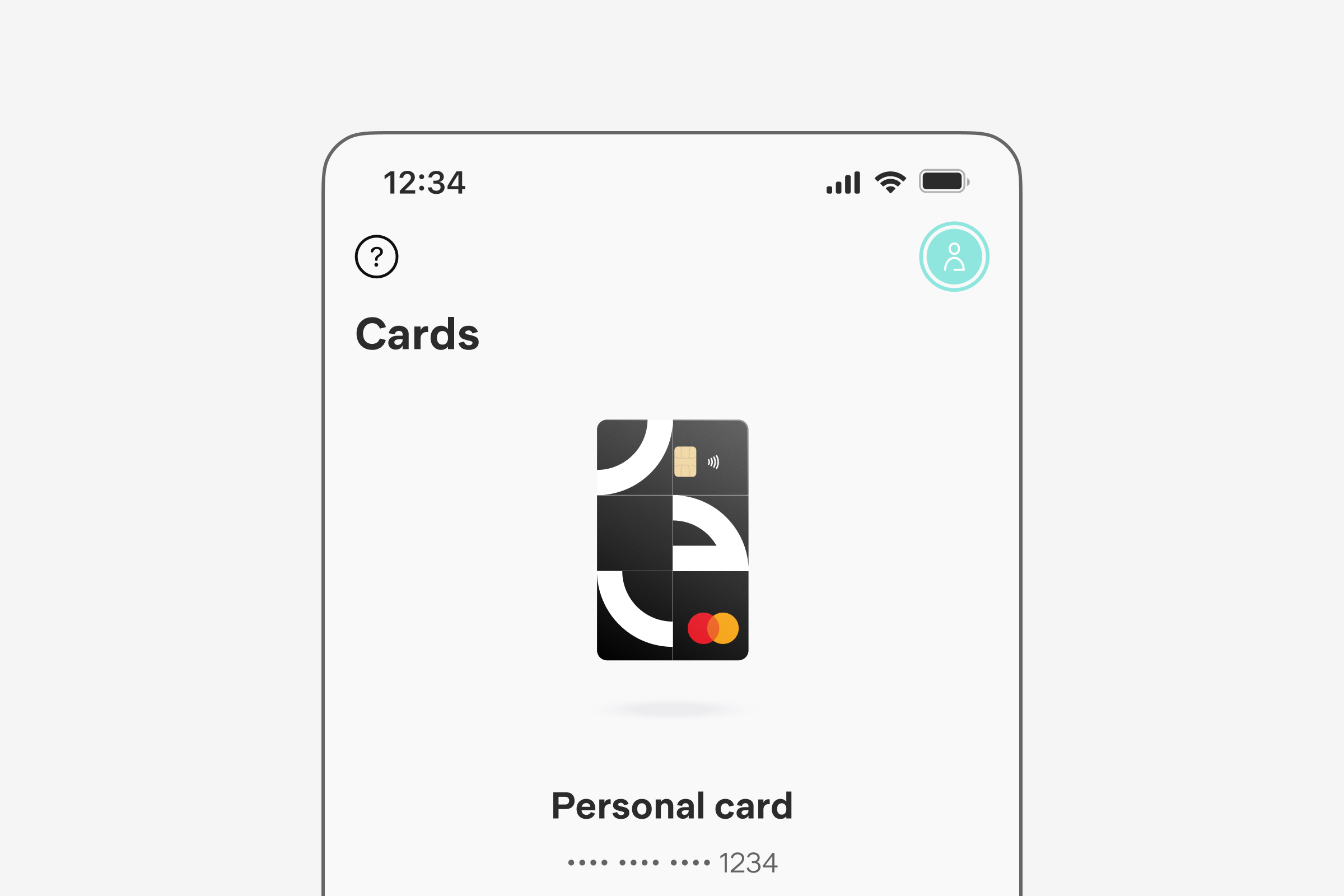

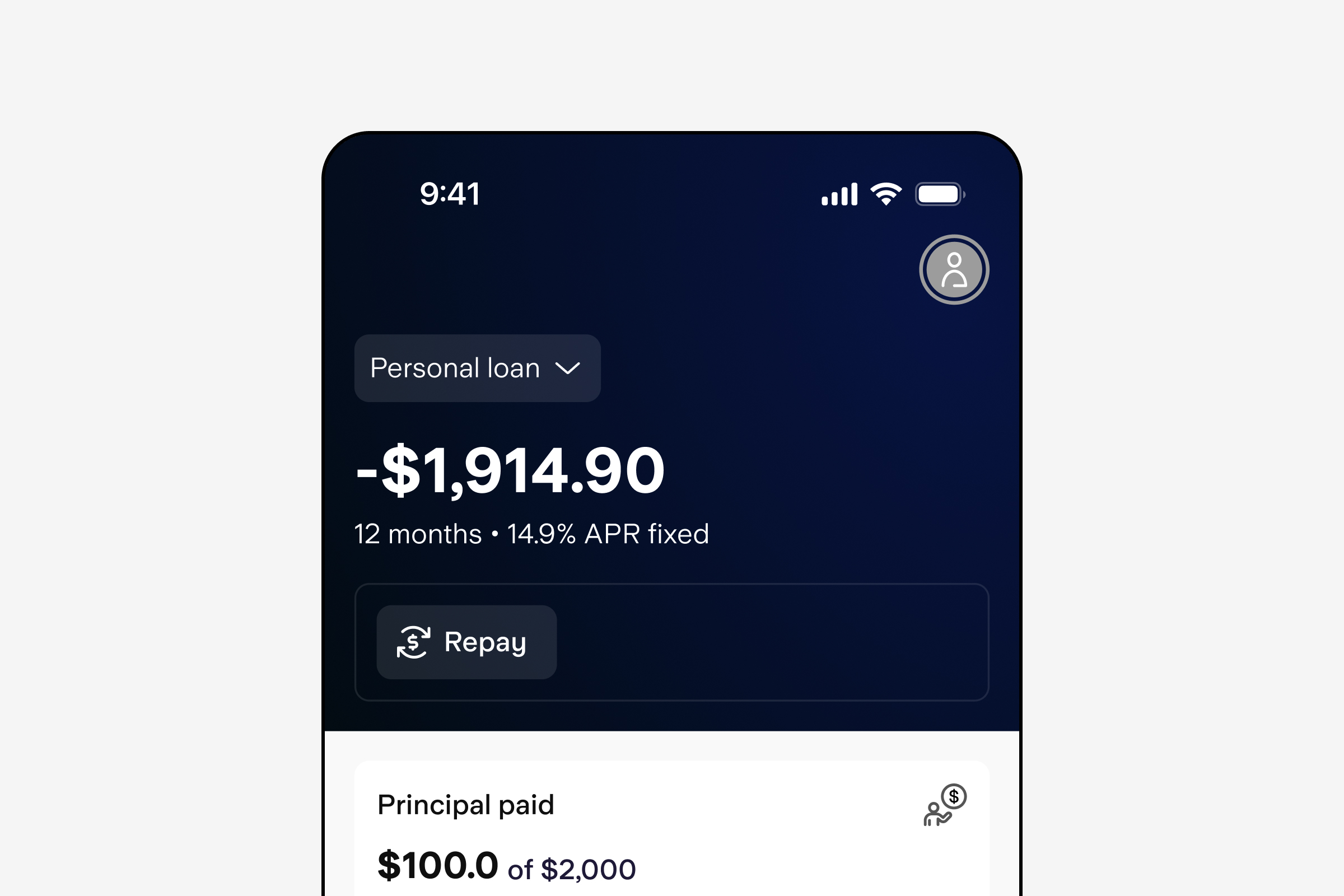

Secured and Unsecured LendingEmpower customers with intuitive loan options

Optimise your lending application experience with Engine’s configurable and flexible lending origination platform.

Engage with your customers in-real time through our management lifecycle, empowered by single customer view and full real time data.

Utilise real time arrears tracking and alerts supported by dynamic forbearance options within Engine’s Management Portal.

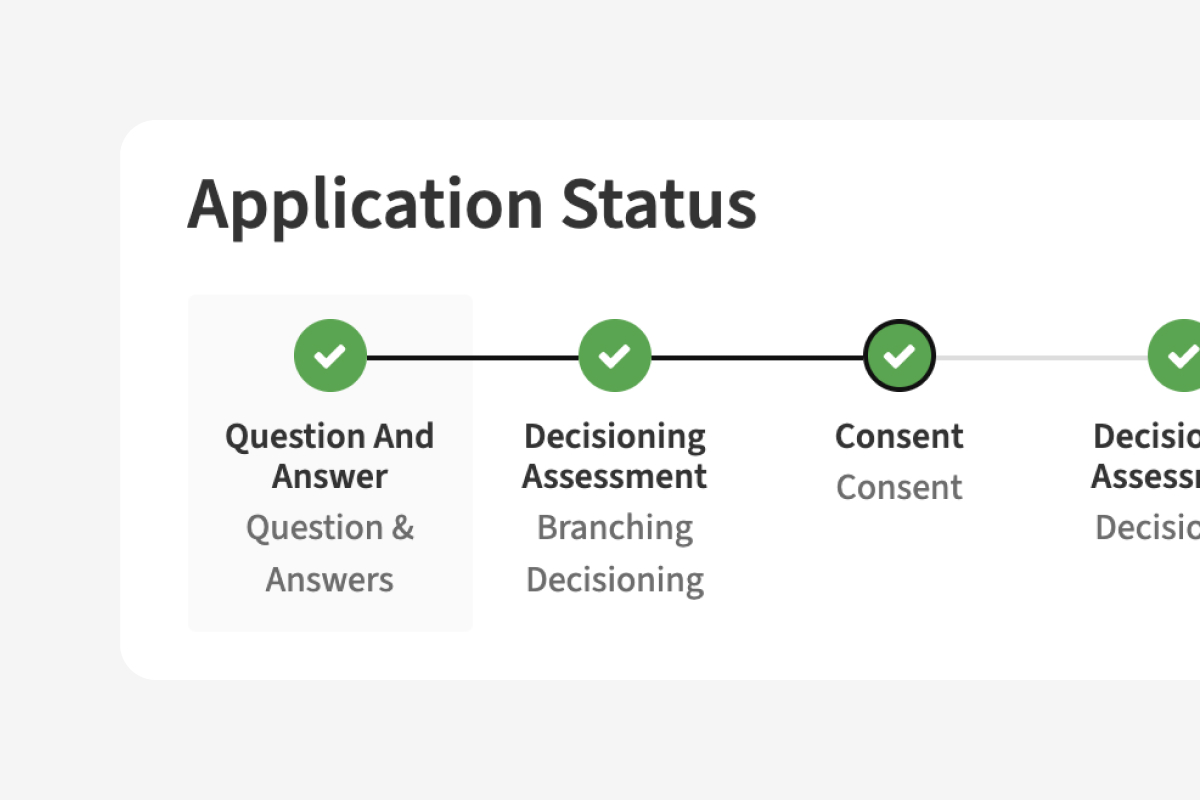

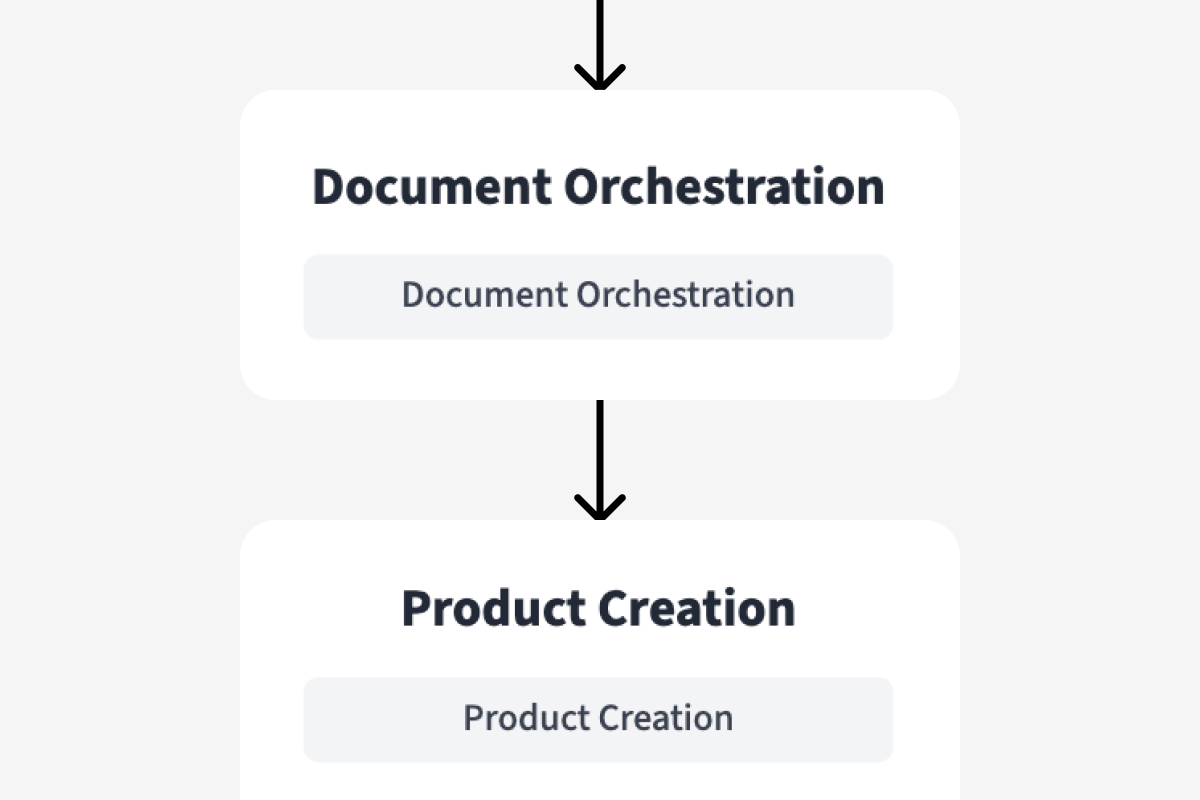

Configure customer journeys with ease using Engine’s steps in any order to tailor the ideal experience for each customer segment.

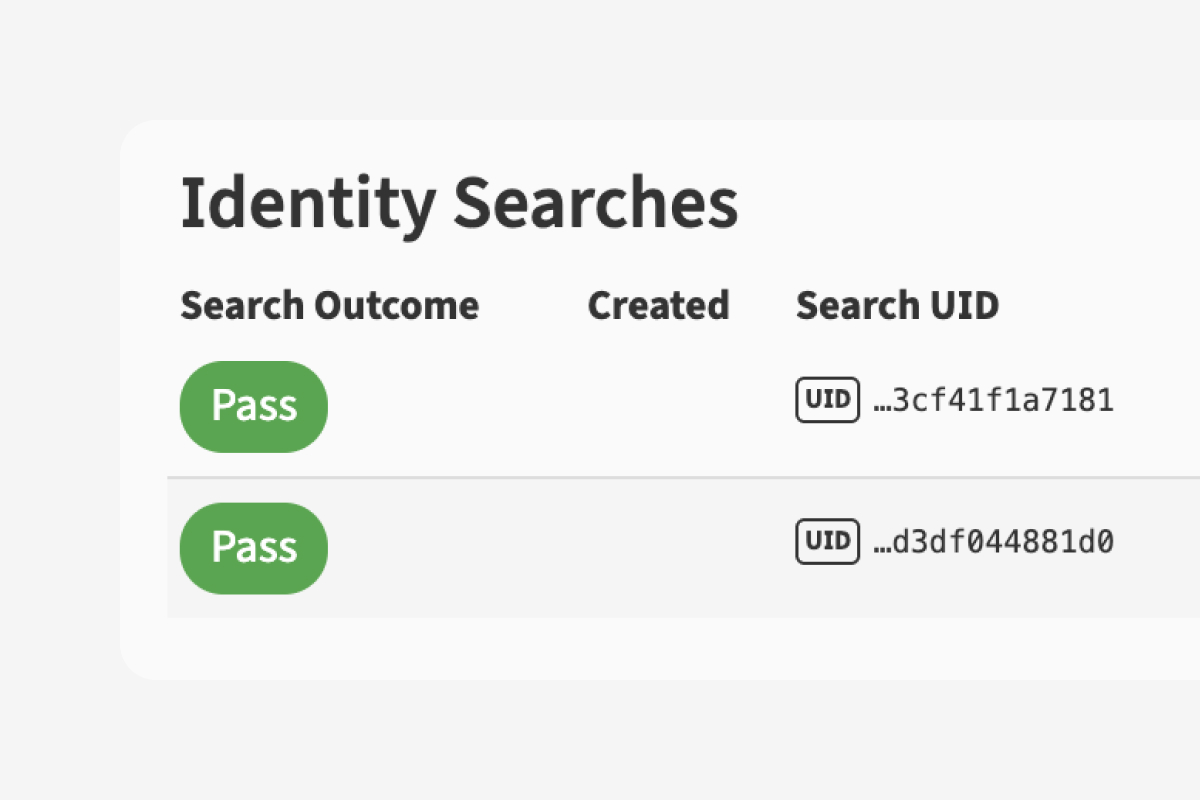

Leverage Engine’s extensive data ecosystem to approve or decline customers at multiple points in the journey for highly flexible decisioning.

Seamlessly connect with third-party decisioning partners for credit scoring, affordability, pricing and risk assessment models.

Integrate with fraud checks, credit bureaus, document generation providers and more, keeping your bank compliant at every step.

Easily maintain a detailed record of each step completed by a customer with Engine’s comprehensive audit log of all lending applications and decisions.

Contact UsWant to learn more?

Whether you’re launching a new digital bank, migrating from a legacy platform, or launching a sidecar proposition, Engine can help you achieve success. Share details about your requirements and we will be in touch.

Are you looking for a UK Banking-as-a-Service solution Contact Starling’s dedicated B2B team to find out more about the services provided.