10 key takeaways: Core modernisation decoded

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

Engine by Starling

Serve customers better – and give employees a smarter way of working

Engine by Starling

With a different way of doing things

Engine helps your operations teams and customer agents deliver market-leading customer experiences, ensuring that every touchpoint they have with your digital bank or product is as simple and seamless as can be.

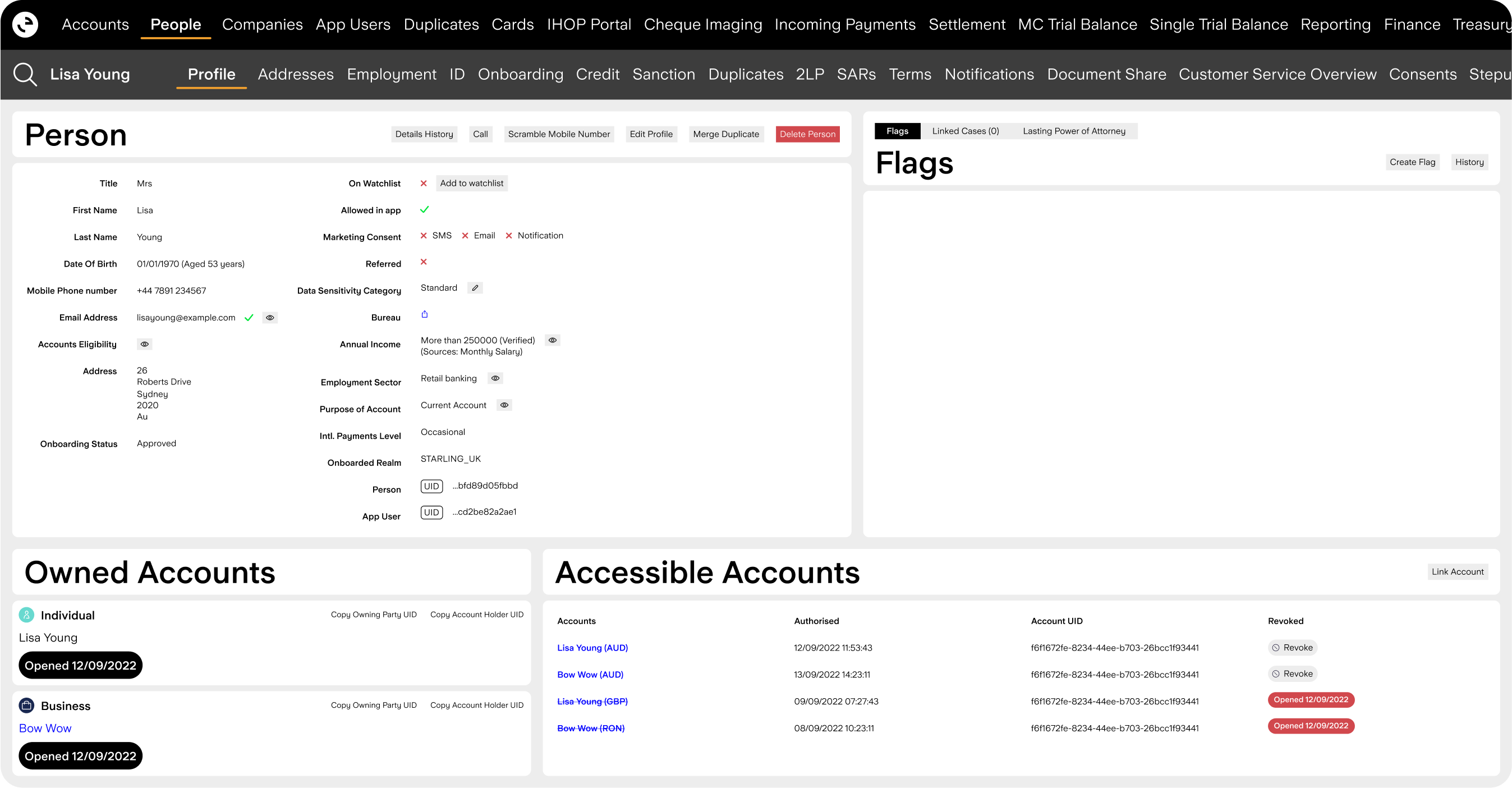

But we’ve also kept the employee experience firmly front of mind. Our Management Portal makes it easy to access all our rich functionality – it’s a first-of-its-kind, single pane of glass tool that makes serving customers easier than ever before. And within that, agents can use our built-in Contact Centre to get a comprehensive view of the customers they’re serving.

Operational Capabilities

Just some of the Operational capabilities available through Engine.

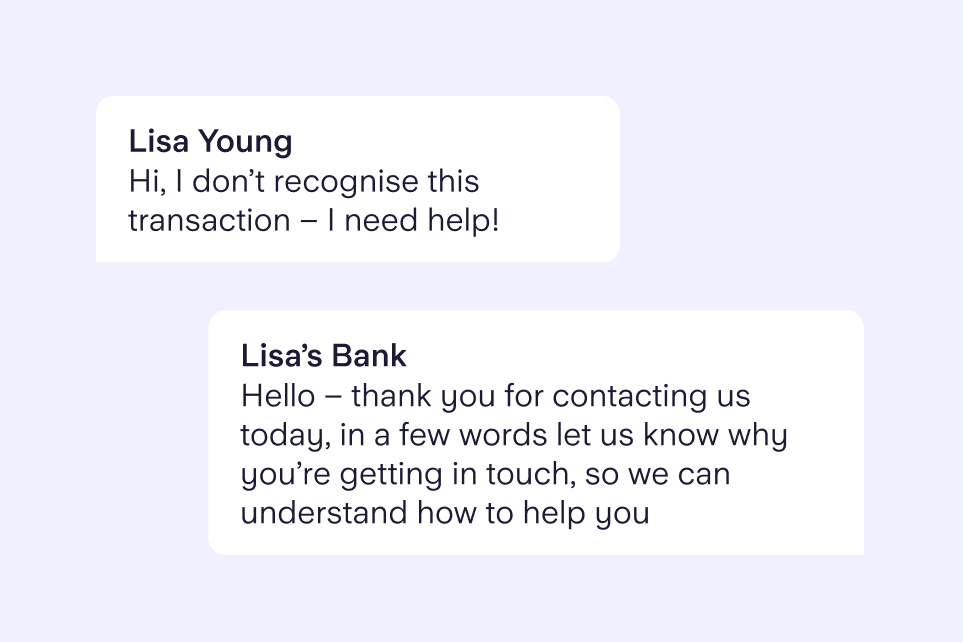

Whether it’s real-life agents or fully self-serve, provide the tools to effectively manage customer queries without losing the human touch.

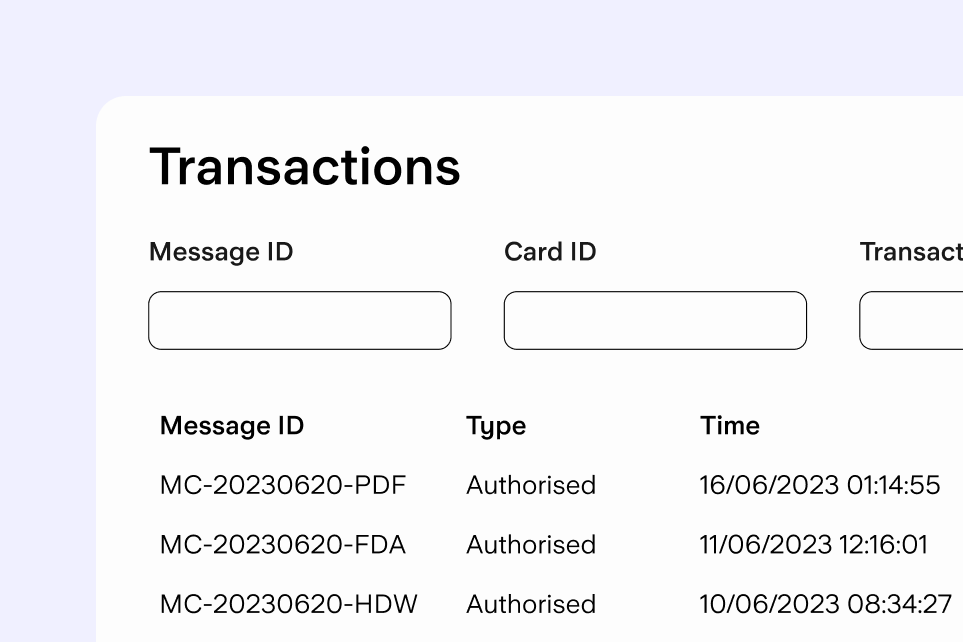

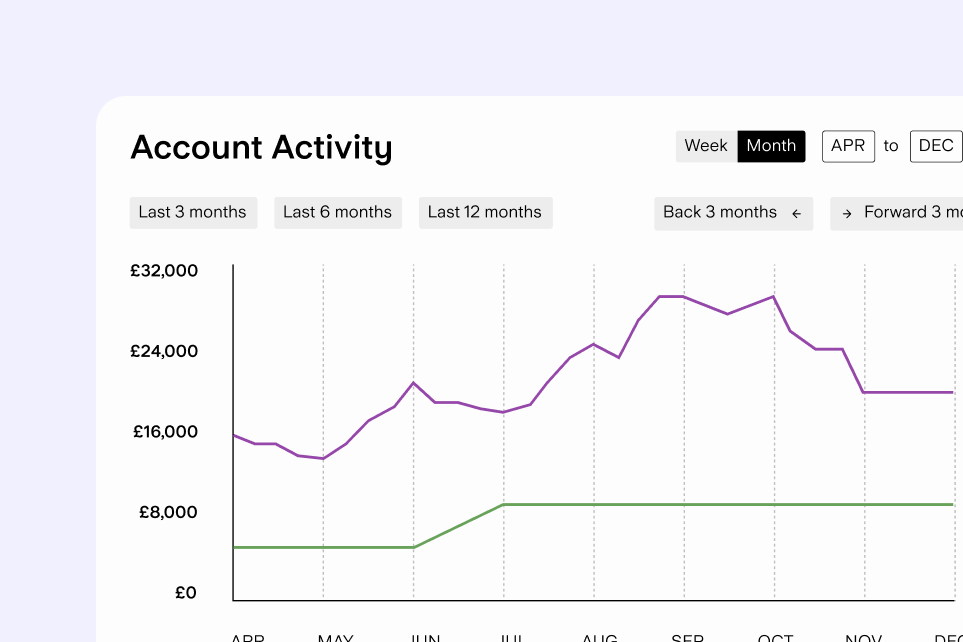

Whether checking transactions or questioning a purchase - Engine’s Management Portal has it covered.

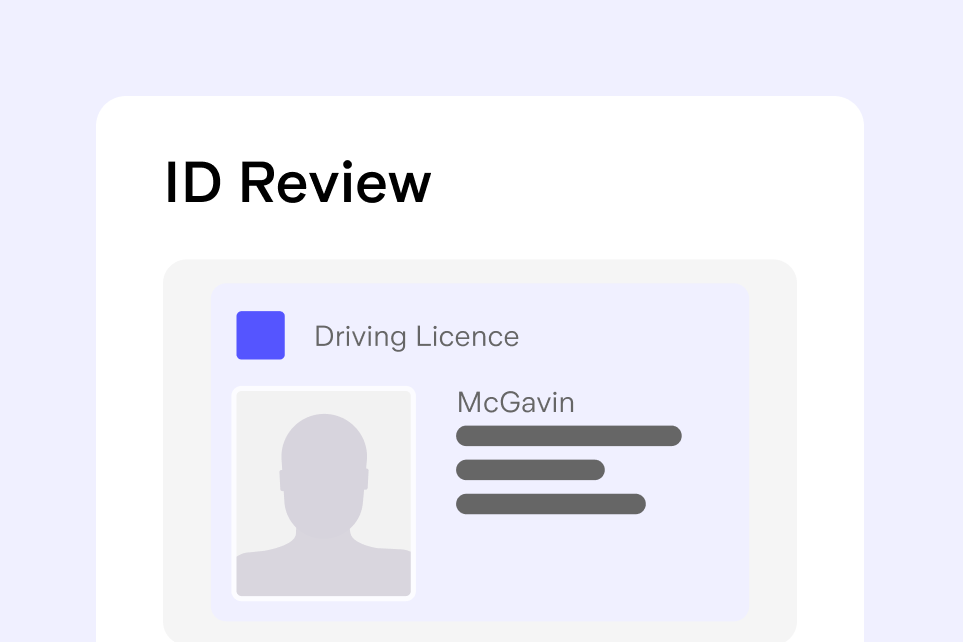

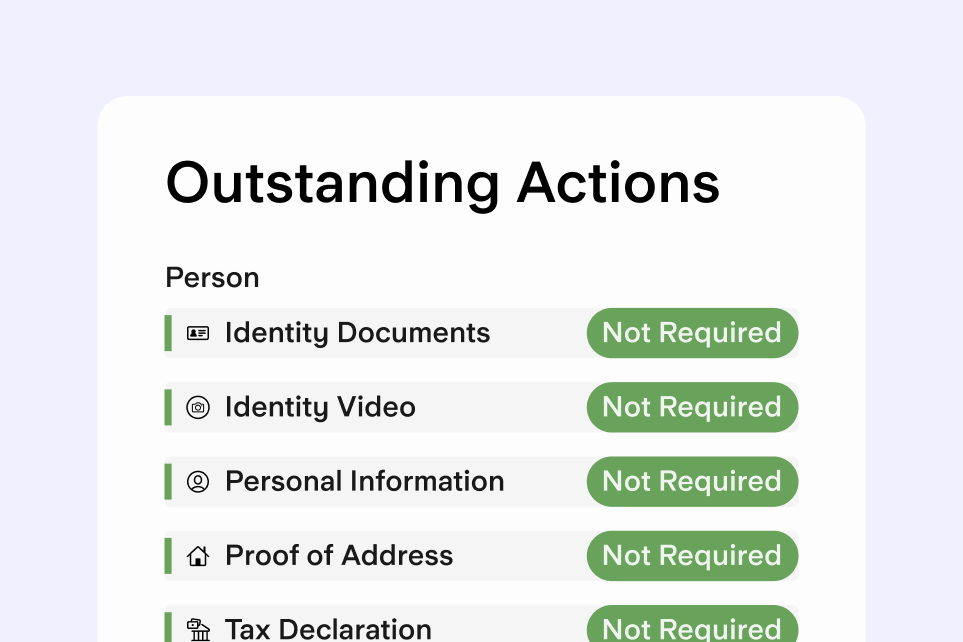

Along with automated rules-based capabilities, onboarding teams can handle the full process in Management Portal.

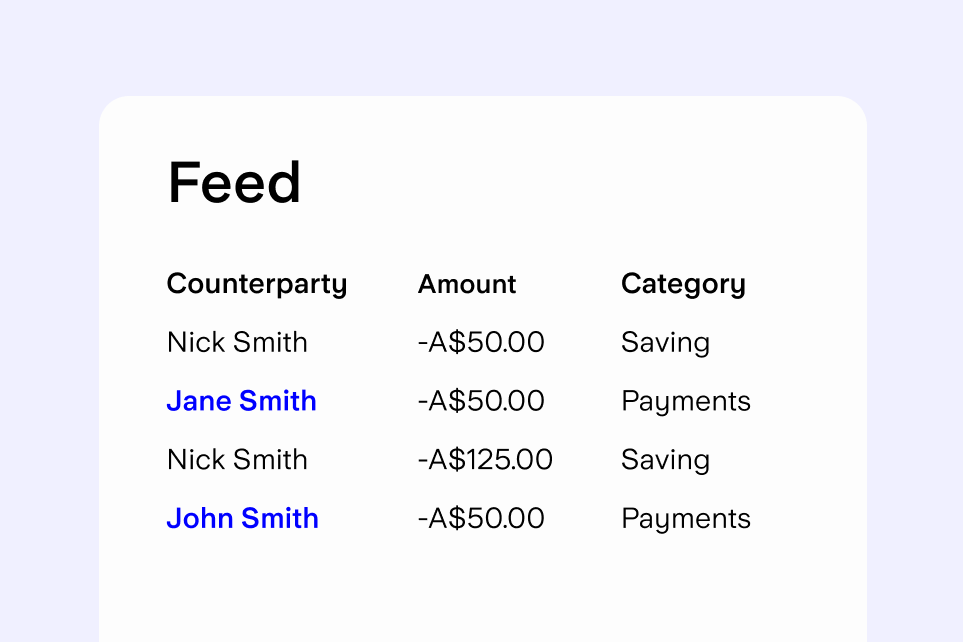

Get a single view of all customer card payments, with info presented at a granular level to deliver meaningful insight.

View all borrowing associated with a customer, apply funds from an account onto the loan, view past payments, and manually post adjustments.

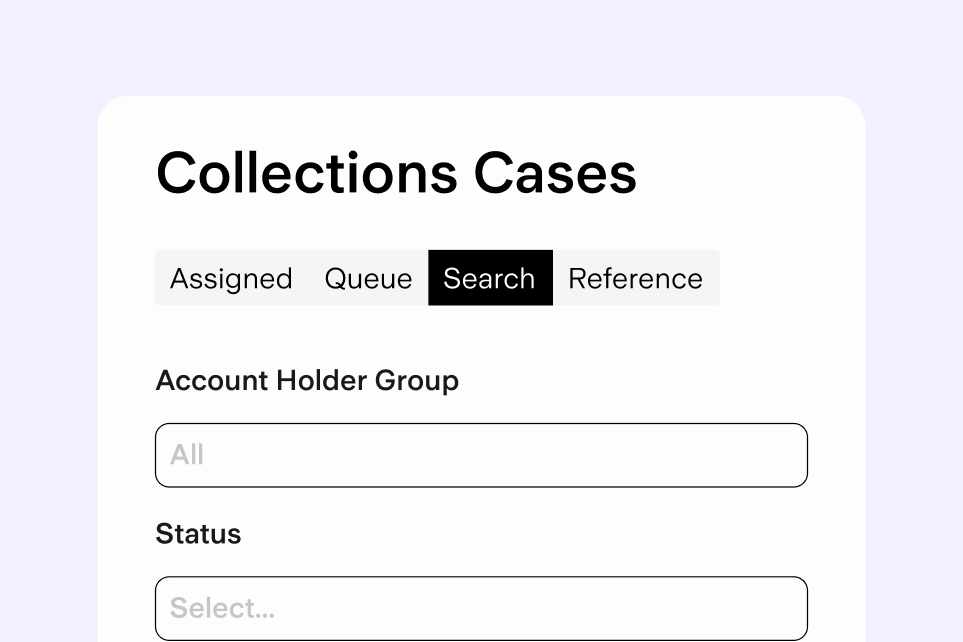

Create, track and manage customer issues relating to loans – support customers sensitively while effectively managing recoveries risk in accordance with regulatory and legal requirements.

Empower your FinCrime teams with the tools and data they need to quickly and accurately review suspicious activity.

Build, launch, and continuously improve new digital products for personal and business banking.

Learn moreEverything required to lay the foundations a bank is built on, from customer ledgers to payments processing.

Learn moreThe processes and tools your employees need to deliver truly industry-leading operational support and customer service, all wrapped up in one single place: Management Portal.

Learn moreDigital-first, human always

In legacy banking, the interface used by customer agents is often disparate, clunky and fails to give a proper view of the customer and all their accounts. In other words: it actively impedes the customer agent from doing the best possible job.

We’ve solved that problem with the agent view in Management Portal. It’s a single pane of glass that gives agents everything they need to deliver exceptional service. All in one place, intuitive to navigate, and effortless to use.

Engine by Starling

In an era where fintechs are redefining the financial landscape, the challenge for traditional banks isn’t just about keeping up—it’s about reimagining core banking from the ground up.

AMP wants to transform the local business and personal banking market by giving Australian customers the digital banking experiences they’ve long deserved.

Engine has been recognised as a Challenger in the 2025 Gartner Magic Quadrant for Retail Core Banking Systems, Europe.