Spotlight

The New Blueprint for Digital Banking

Engine and Converge by Deloitte

By Nick Drewett, Chief Commercial Officer, Engine by Starling and Michael Robinson, Converge by Deloitte UK Founder

The banking industry has been slow to move from legacy systems to modern infrastructure. Global players in e-commerce and entertainment sit at the forefront of customer-first experiences, and have set the tone for innovative products and services. With highly-personalised, frictionless customer experiences, these services benefit from significant user satisfaction. These modern, scalable platforms champion seamless journeys that have not, until recently, been replicated in the banking sector.

Previously dominated by players operating on decades-old core systems, the banking market is now facing a choice: innovate, or struggle to keep up. Retail and business customers are demanding more from their banks, and now they have a choice. In the last decade, forward-looking organisations have emerged, bringing a new standard to the market of what’s possible in banking – that is, if banks choose to embrace the benefits of banking modernisation, for their organisation and their customers.

The market is changing

The foundational shift in the modern banking landscape has been the establishment of digital channels not as an alternative, but as the primary mode of engagement and communication with customers. According to a 2025 report from Deloitte, 35% of banking customers increased online banking usage after the pandemic, and the number of customers expected to use digital banking services will reach 4.2 billion by 2026.

While customers have been accustomed to the disjointed, cumbersome digital banking applications offered by large legacy banks still operating on older, monolithic cores, they are now demanding more from their banks. Digital-first neobanks offer a new opportunity for both customers and other banks. The benefits of cloud-native, seamless banking experiences abound for customers seeking straightforward services, and for financial institutions aiming to maintain satisfaction in loyal customer bases - while proactively modernising to capture new market segments.

The success of Starling and other neobanks, in the UK and beyond, has proven this model, and demonstrated that modern core banking technology is no longer a ‘nice to have’.

"Operating a bank on a well architected, digital-first technology stack is an essential prerequisite for unlocking real business results and bringing value to customers."

Michael Robinson, Converge by Deloitte UK Founder

The market is changing, and banks are moving away from outdated cores, having recognised their disadvantages. More modern offerings mean banks can free themselves of the burdens of low agility, high maintenance costs and scalability challenges. Core modernisation projects have come to rely on architecture founded on microservices, which breaks down large, monolithic applications into a collection of smaller, independently deployable services. Much like tech giants Netflix and Amazon, modern cores break down services to optimise for resilience. While legacy banking views operational risk as a guardrail to prevent movement, valuing stability at the cost of agility, cloud-native players view it as a fluid constraint, utilising automation to ensure that when parts of the system break, the whole survives. The result of this ‘always on’ approach is increased operational resilience; the system is able to auto-heal without human intervention, and without major interruption to services.

The buy versus build debate

As banks consider modernising their core systems, they face a critical decision: whether to buy an existing solution or build their own core banking platform. This age-old debate resurfaces repeatedly, and each approach comes with its own set of challenges.

On the one hand, buying an off-the-shelf solution can provide the majority of the capabilities banks need, enabling faster implementation and leveraging the expertise of established vendors. However, this approach often comes with the risk of vendor lock-in, limited control, and restrictions on the ability to innovate. Alternatively, building a bespoke solution from scratch offers banks complete control over their platform, allowing them to tailor it to their specific needs. Yet, this approach introduces additional complexity, higher costs and increased risk associated with designing, building, and maintaining the solution.

For banks to truly embrace modernisation, they need a solution that strikes a balance between these two extremes. Such a solution must enable banks to deliver products and services that meet the ever-evolving needs of customers while adapting seamlessly to ongoing regulatory changes. It should also allow banks to maintain ownership and control over data residency and security, empower colleagues to better serve customers, and reduce the total cost of ownership by avoiding high ongoing fees. Banks must be able to leverage the innovation of partners without being locked into specific vendors, all while operating on a stable, scalable, and future-proof platform.

Despite the ongoing debate, neither building nor buying alone can deliver all of these outcomes. The right approach lies in finding a balanced solution that combines the best of both worlds: the control and customisation of building with the speed and efficiency of buying.

However, achieving this balance has proven more challenging in practice than in principle. Many solutions fail to deliver on their promises. Platform vendors often design their products to maximise feature adoption, leading to unintended coupling and reduced modularity. Similarly, system integrators and even in-house technology teams may aim to build cutting-edge solutions, but these efforts can result in unforeseen complexity during implementation and scaling.

To overcome these challenges, banks need partners who truly understand their unique operational needs. They require platform vendors who can provide the right level of control and flexibility, and a systems integrator with the experience to deliver these solutions with minimal real-world complexity.

A new blueprint for banking modernisation

What banks require is a new approach – one that combines the benefits of more modular offerings with the operational and architectural harmony of a holistic solution. This is where a new blueprint for banking transformation emerges, offering a transformative path forward for banks seeking to overcome the limitations of legacy systems and embrace the future of digital banking.

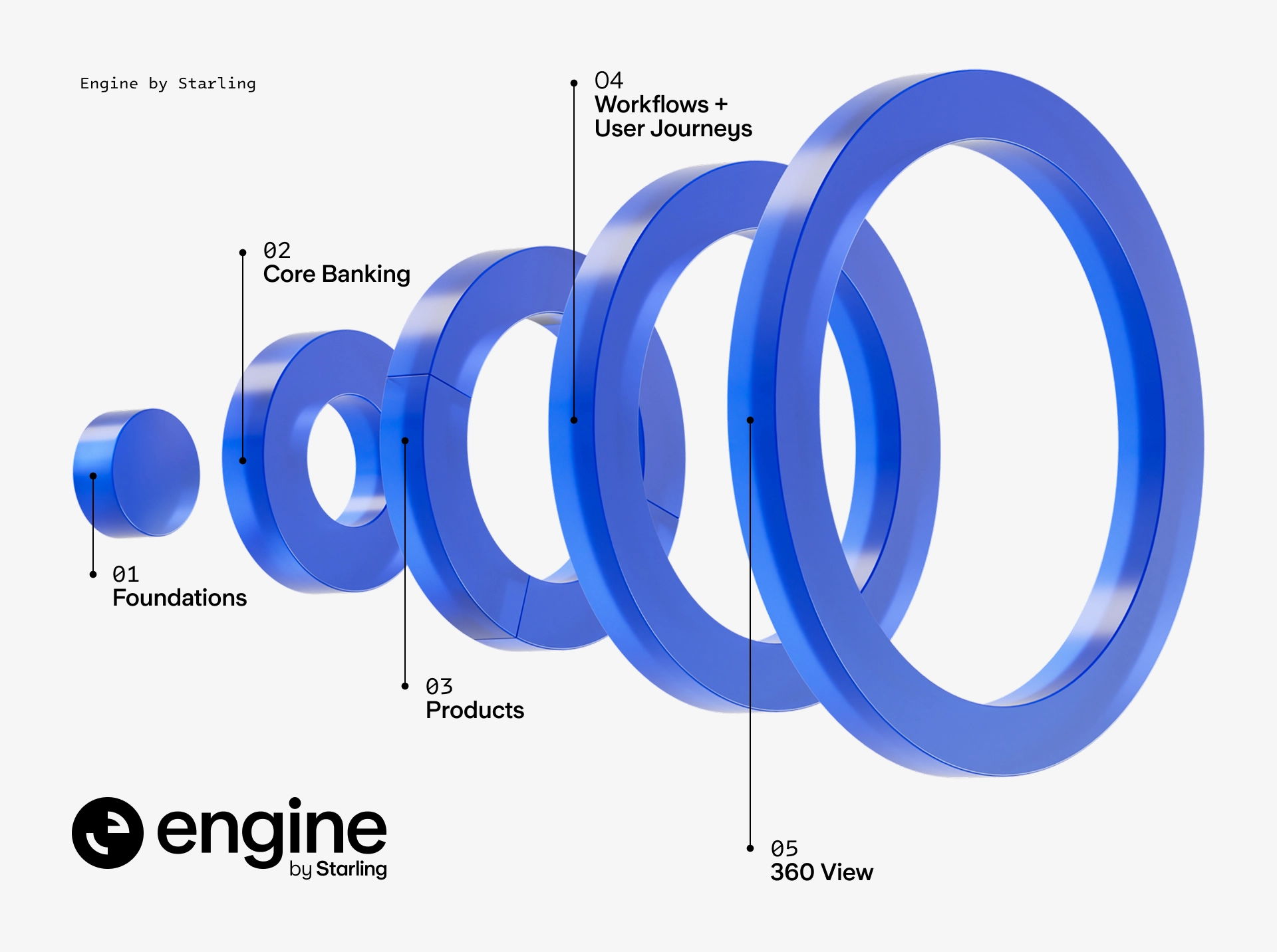

Engine by Starling, in partnership with Converge by Deloitte, offers this solution. Engine by Starling is a cloud-native digital banking platform, designed for continuous innovation. Built on reliable and scalable foundations, Engine’s API-first platform seamlessly integrates with third-party services and existing legacy architecture. Built to power Starling, one of the UK’s most successful digital banks, Engine’s solution comes with a built-in operating model for a market-leading, cloud-native bank. Engine’s teams truly understand the realities and complexities of banks’ requirements when undergoing modernisation projects.

Engine provides everything needed to run a digital bank end-to-end, with a bank’s operations and data stored all in one place, eliminating data siloes and modernisation inefficiencies. Combining the benefits of rapid innovation from other composable and microservices solutions, while prioritising completeness and data transparency, Engine offers an alternative for banks aiming to modernise effectively and ensure ongoing growth.

Converge by Deloitte, meanwhile, brings unparalleled data, integration and orchestration capability, as well as asset maturity, and a proven track record in banking transformation. With deep knowledge of banking, risk and compliance, Converge empowers banks to achieve goals quickly, without compromising on risk. Backed by Deloitte’s experience in executing complex transformations, Converge empowers banks to modernise, drive growth and enhance efficiency.

"Together, Engine and Converge by Deloitte offer an entirely new way for banks to build, transform and modernise."

Nick Drewett, Chief Commercial Officer, Engine by Starling

Engine and Converge combine the strengths of both organisations to provide the blueprint for modern banking, offering a core banking platform, a ready-to-go digital operating model and deep global transformation experience.

Banks benefit from an end-to-end, architecturally coherent platform, from core to channels, without the complexity of integrating these elements in-house. Whether launching a new bank or migrating legacy systems to a future-proof foundation, this approach provides the full spectrum of support required to launch a fully-operational, market-leading bank on day one of go-live, while giving banks the flexibility to make their bank their own.

A strategic alliance for the future

Engine by Starling’s alliance with Deloitte means bringing unparalleled benefits to clients aiming to modernise their offering, or launch an entirely new proposition. Engine and Converge by Deloitte bring implementation experience and ongoing support backed by expertise in both greenfield and brownfield implementations. With the support of Engine’s technology platform, built to run an award-winning UK bank, Deloitte’s scale and ability to deliver as an accelerator for clients, and the combined expertise of both, client projects are in safe hands.

Engine and Converge by Deloitte, together, bring clients a new way to transform. The alliance delivers more than just a platform; it provides a comprehensive blueprint that combines leading platform capabilities, a proven operating model, and deep delivery experience. This integrated solution is designed to unlock significant value by reducing integration friction and complexity,thereby increasing the speed of delivery for new propositions. Ultimately, this enables banks to drive profound transformation, foster growth, enhance efficiency, and ensure long-term stability

Building a bank with Engine and Deloitte means clients have flexibility where they need it - and time to focus on what matters most: bringing ongoing value to customers. Choosing an end-to-end solution with rapid delivery timelines and ongoing support means clients can quickly reap the benefits of the next generation of core banking services.

In summary:

Technical expertise: Offering a new way to transform, Engine and Deloitte provide an end-to-end modernisation solution, from best-in-class technology to delivery

Decades of experience: Engine and Deloitte bring extensive delivery capability supported by Deloitte’s scale and Engine’s product offering

Built-in operating model: Clients benefit from Engine’s built-in operating model, honed by nearly a decade of running a leading UK bank, and Deloitte’s extensive advisory experience

Innovation at speed: Pre-built, production-proven capabilities and accelerators, as well as Engine’s customer-facing SDKs, cut launch times dramatically

A long term partnership: Engine and Deloitte’s managed service and innovation roadmaps are designed to keep clients ahead for the next decade and beyond

Focus on achieving value: Engine and Deloitte reduce integration friction and complexity

Together, Engine and Deloitte address clients’ pain points and goals holistically, from technology to operating model and culture. These implementations are about more than the technology - the cultural change is just as crucial as an efficient technology stack.