Core BankingOnboarding

Help your bank grow in a digital world with automated mobile onboarding.

OnboardingSeamlessly onboard personal and business customers

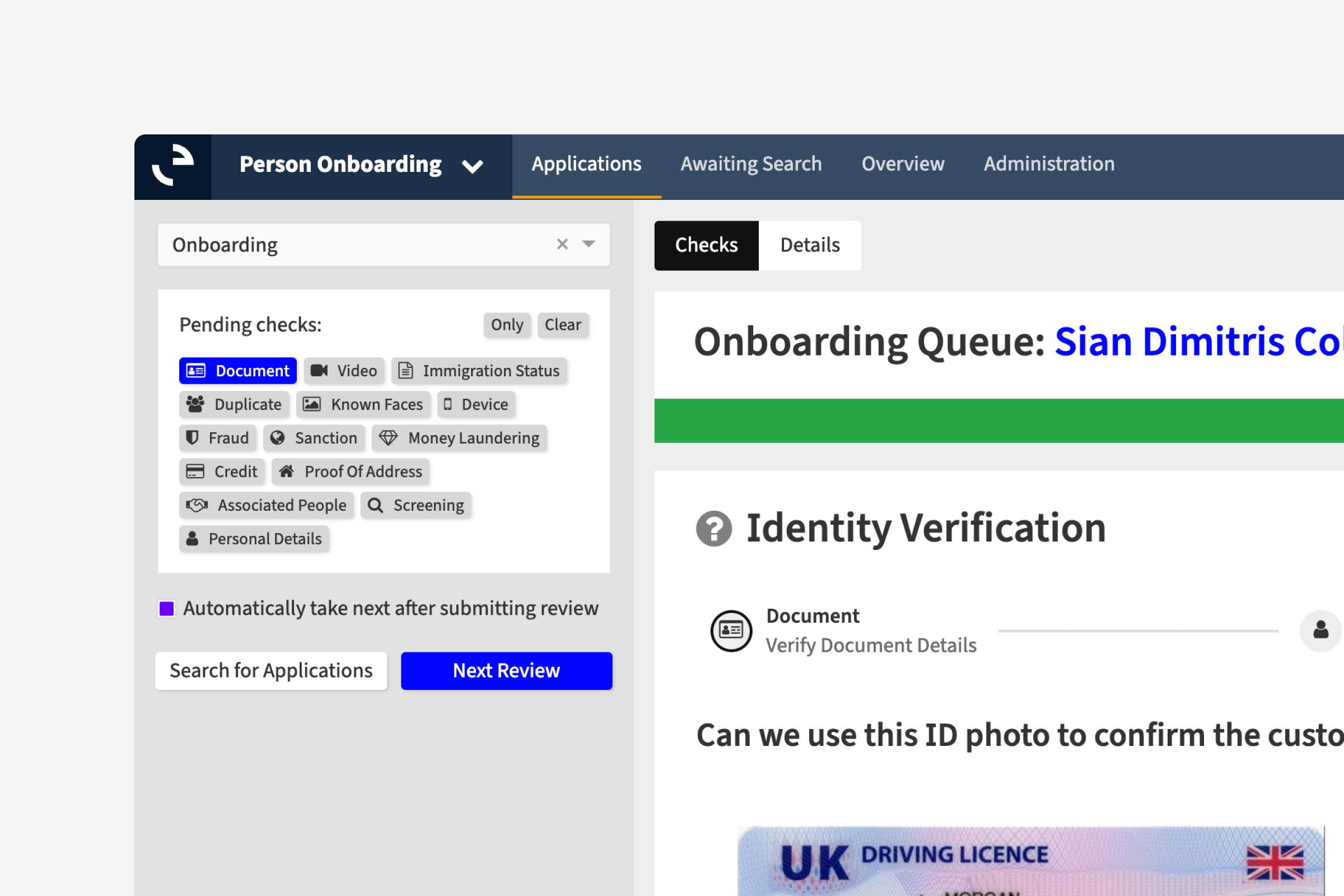

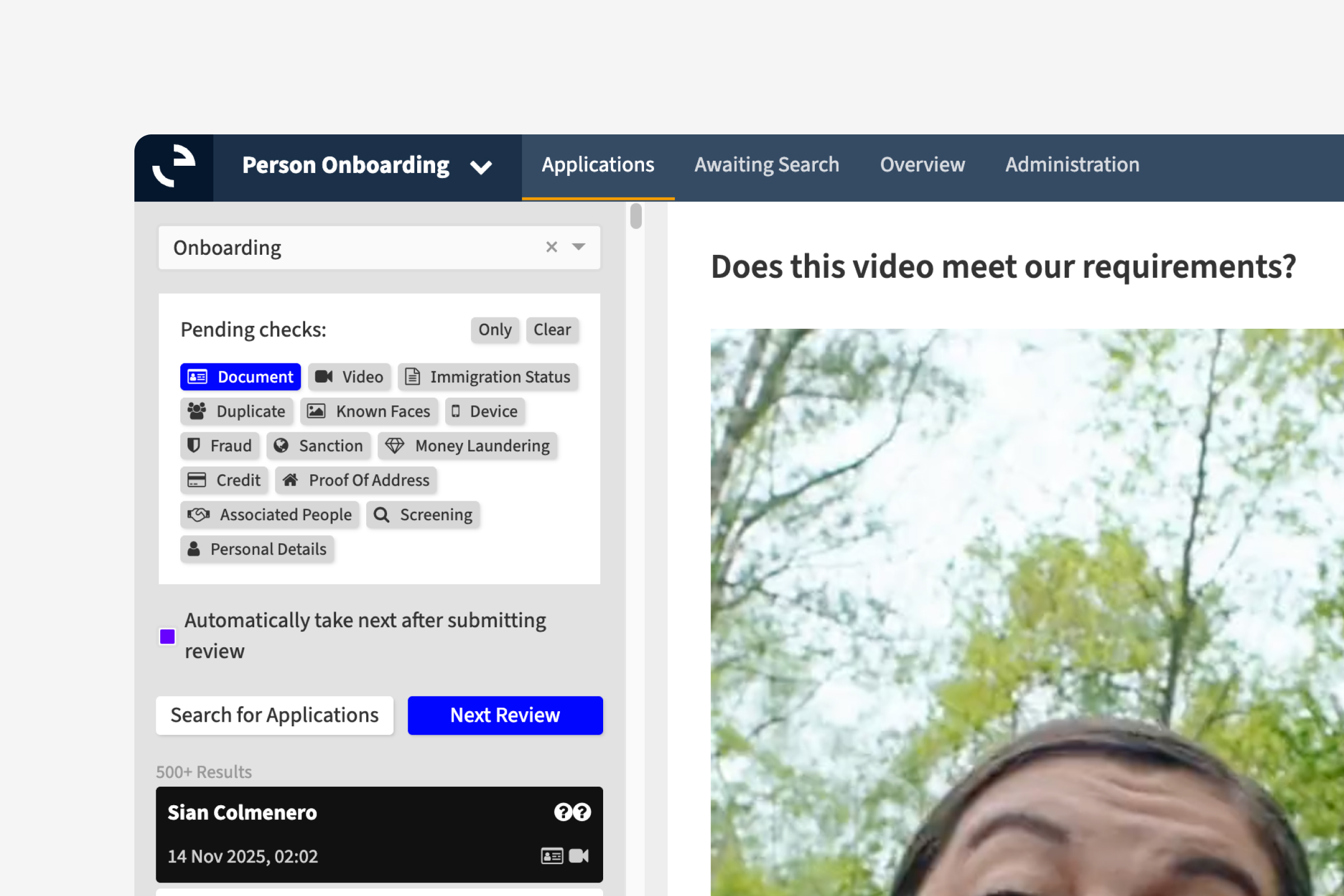

Alongside automated rules-based capabilities, your bank’s onboarding teams can oversee every step of the process, ensuring rigorous verification and risk procedures are in place.

Ensure security and compliance by capturing identity documentation and a selfie video to verify a customer’s identity before allowing them to open a retail account. For business customers, easily capture public information and documentary evidence.

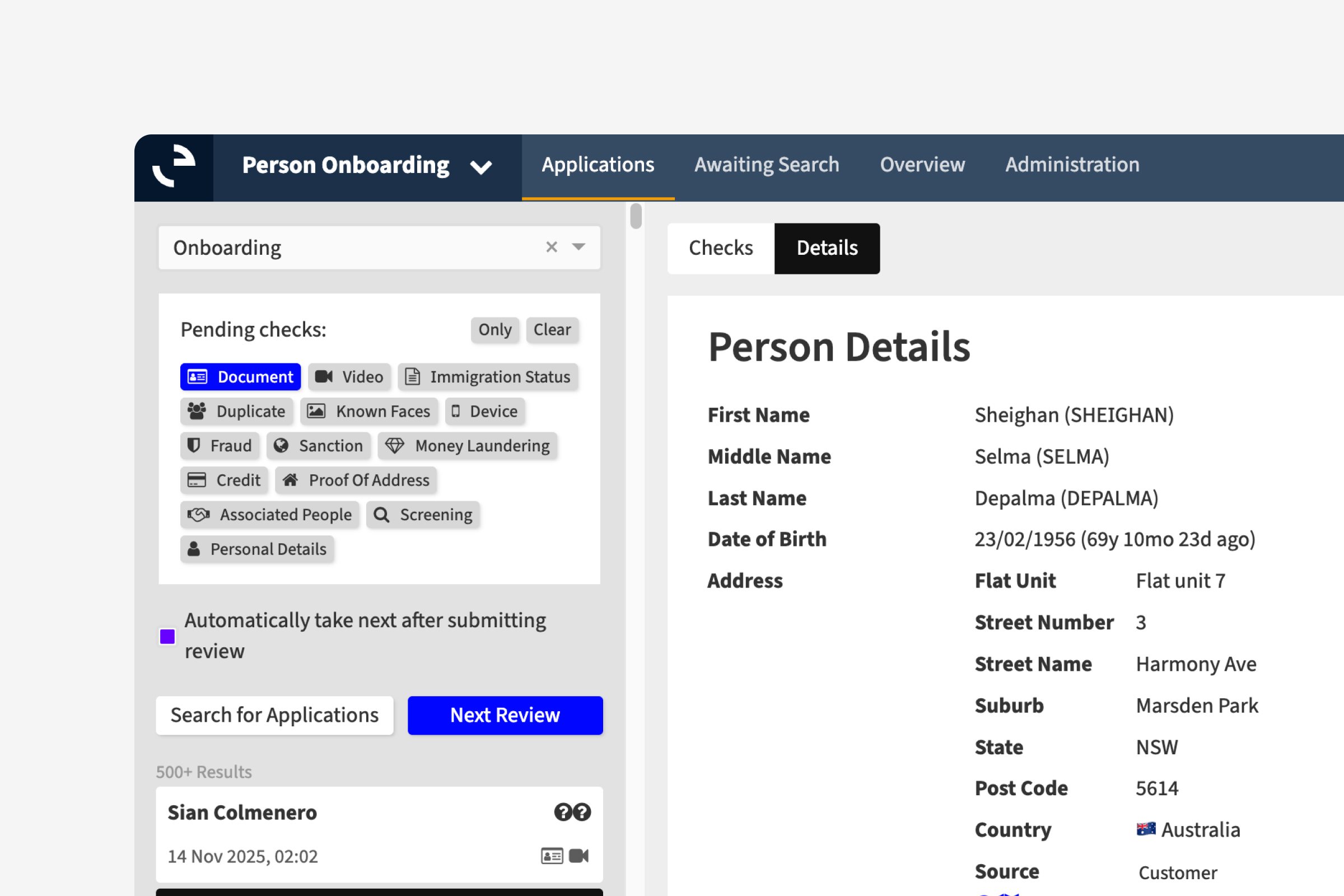

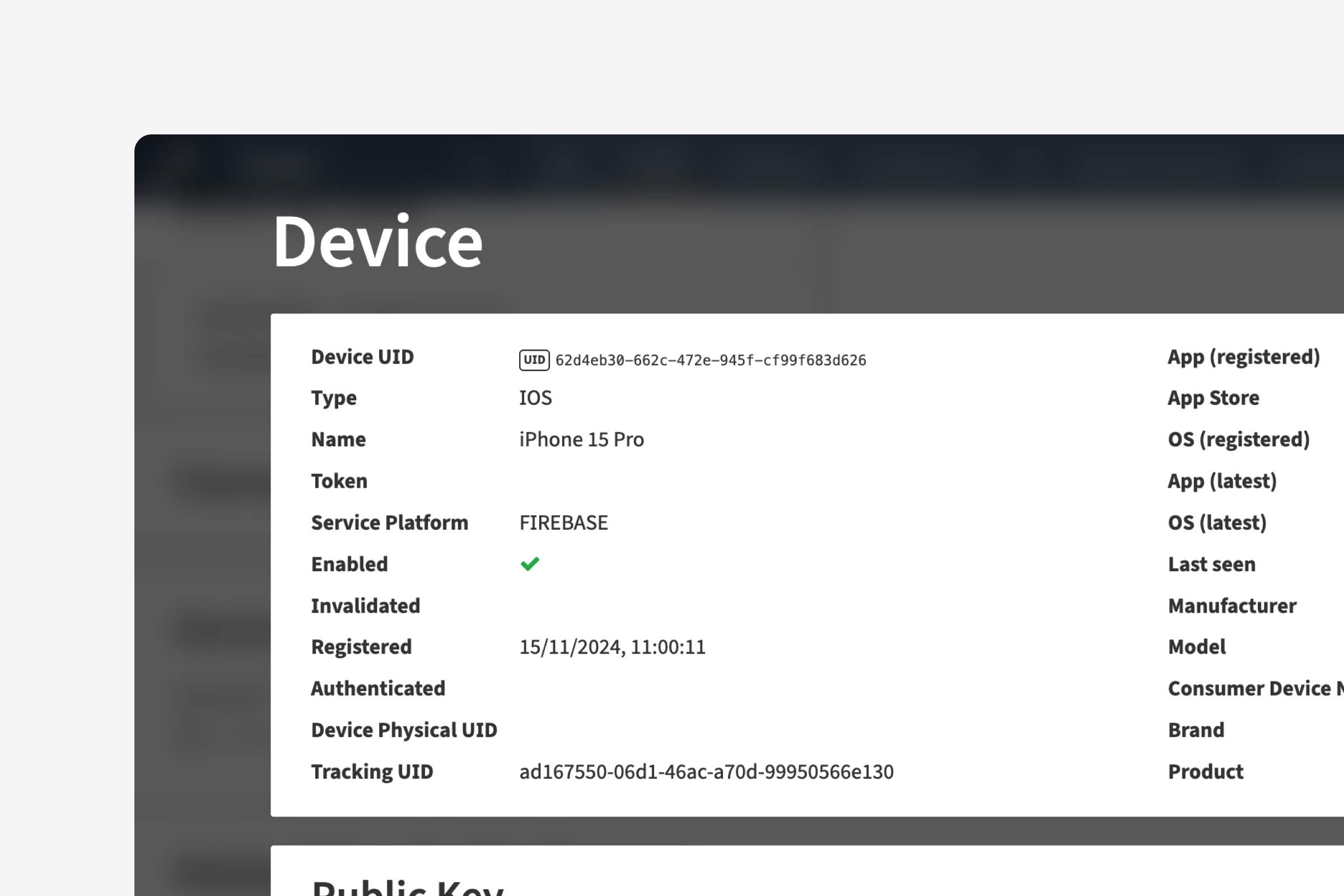

Give your employees visibility over extensive customer information to enable smooth servicing including. Employees can view and update: personal information; linked accounts and activity; consents and preferences; devices and related accounts and customer communication history.

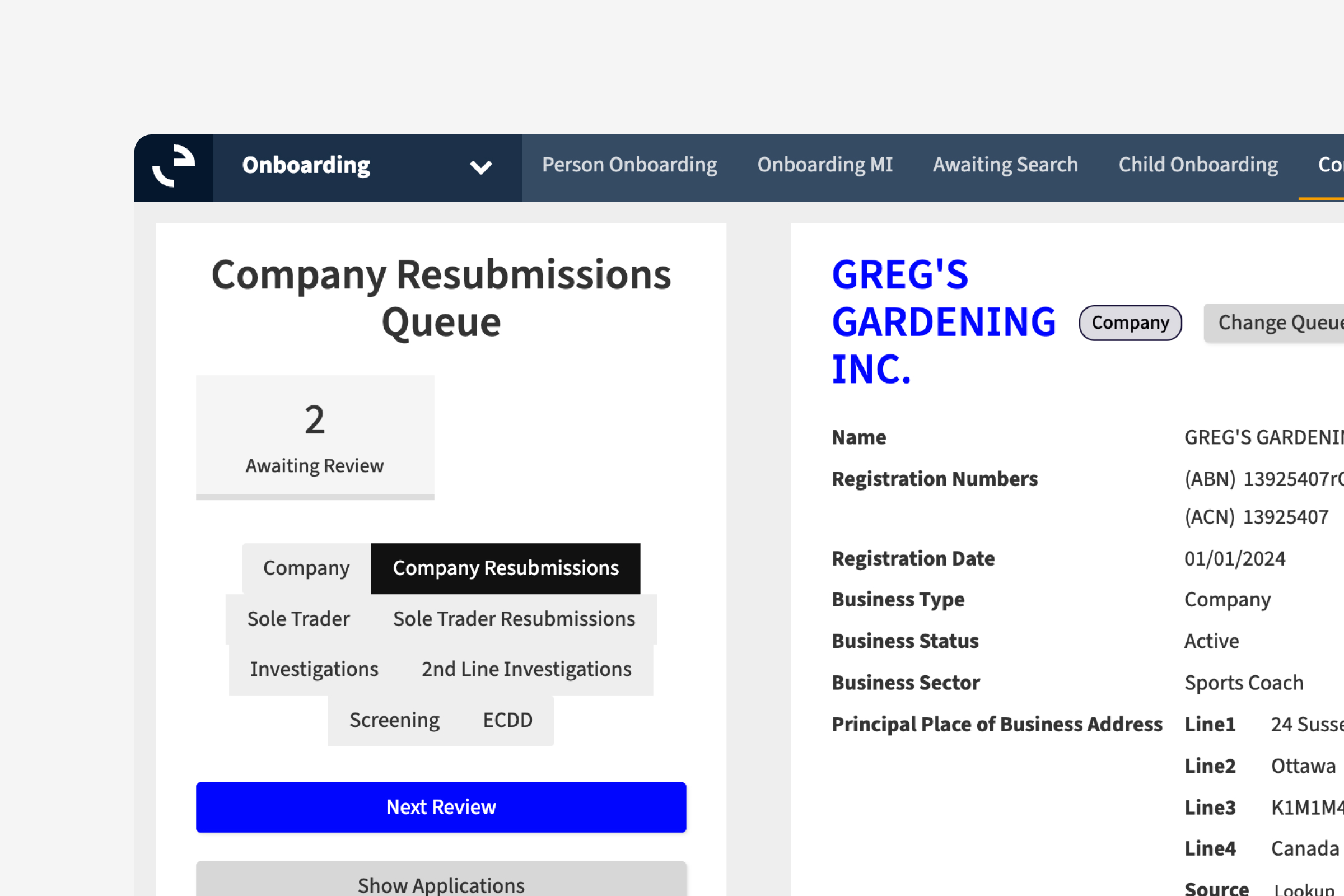

Understand business customers with an extensive view of all businesses and their linked accounts showing information. Seamlessly access basic business details, business account activity, linked business owners and more.

Keep your customers secure by managing linked devices, adding second-level authentication and adding manual review steps for suspicious login attempts. The Engine platform also supports returning customer and reset processes, leveraging the original onboarding decision and documentation to keep accounts secure.

Core Banking