Case study

Salt Bank

See all Case Studies

Project year:

2023

Bank type:

Digital Greenfield

Segment:

Retail

Geography:

Romania

Time to launch:

<12 months

Salt Bank is based in Bucharest, Romania and is a subsidiary of Banca Transilvania, the largest bank in Southeastern Europe.

The Salt team had a bold vision for a better, smarter way for Romanian customers to bank with digital-native, mobile-first experiences. They wanted to truly disrupt the Romanian banking market and put the customer at the heart of their offering, combining the innovation and agility offered by modern fintech with the safety and security of being a licensed, regulated bank.

By partnering with Engine, Salt has successfully brought its digital banking vision to life with the launch of its app in April 2024 which already had 80,000 pre-enrolled customers thanks to an early adopter program.

“We have strong ambitions to disrupt the banking market in Romania by offering customers simple and seamless digital experiences.”

Gabriela Nistor

CEO of Salt Bank

Salt Bank’s mobile app home screen designed to help customers easily manage their money.

Banking, as you want it.

Our journey with Salt began when Gabriela Nistor, the bank’s CEO, and management team came to London to meet with us.

Starling’s story in the UK was a key topic of conversation, with the Salt team wanting to get under the hood of how the bank had achieved success. Starling is a pioneer in the digital banking world, launched in 2014 with a mission to change banking for good, it is now a highly profitable bank and was one of the first mobile-only banks built entirely in the cloud and on its own proprietary technology - Engine. Starling now has over 4 million accounts in the UK that it can service cost effectively and at scale while achieving consistently high customer satisfaction scores. Much of Starling’s success comes from its technology, and Engine is the business tasked with taking that core banking technology to other banks around the world.

When Gabriela and team discussed their ambitions and goals for Salt the parallels were clear. Engine had the right technology platform and approach that they needed and the real-world experience of building and running a successful digital bank. Both teams were motivated with a real belief and shared vision for what could be achieved for the Romanian market and project implementation started in March/April 2023.

Fast forward 12 months, Salt is now Engine’s first client to go live and a deep relationship has been built on trust and a mutual understanding that solutions must enhance customers’ lives and empower their everyday banking needs.

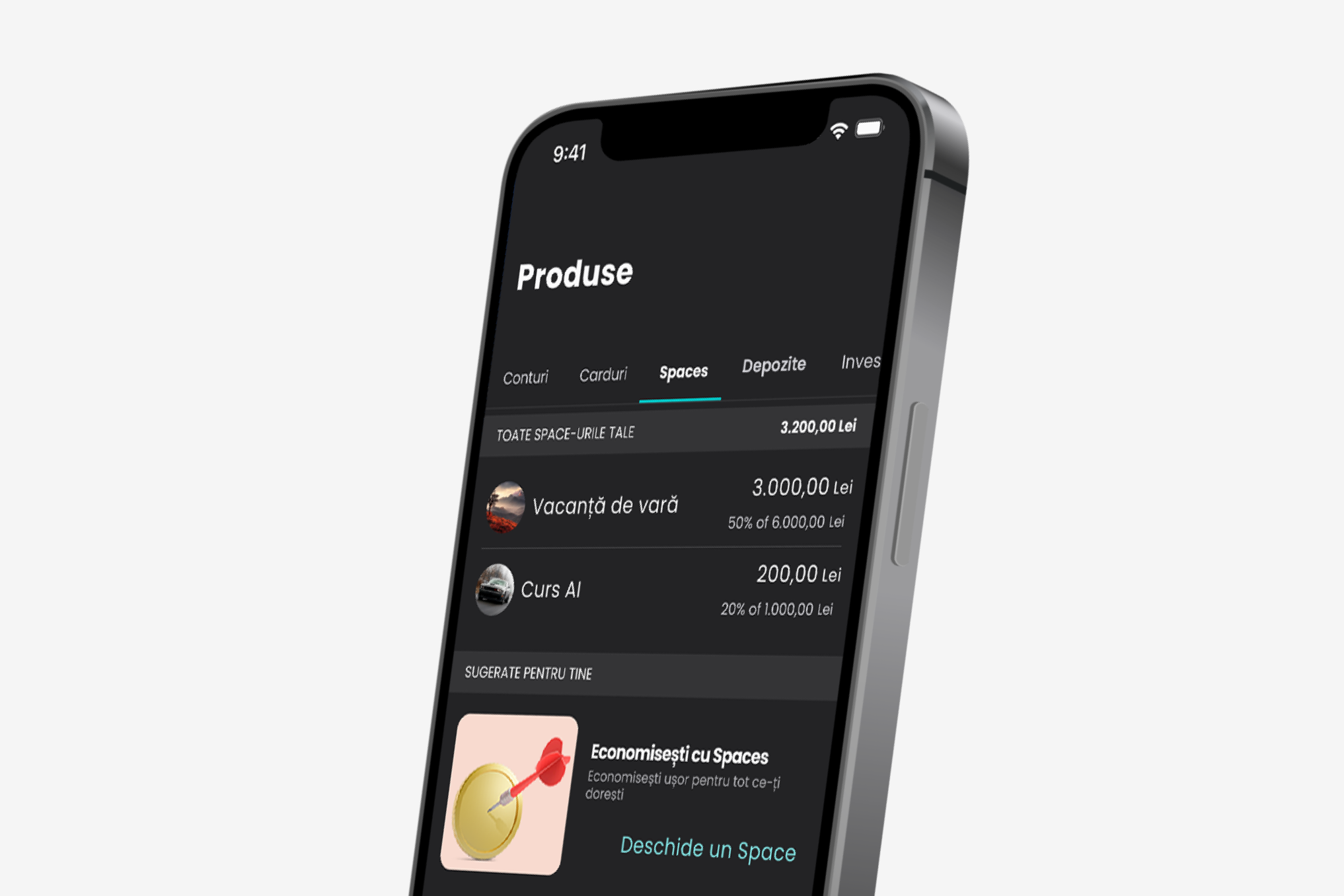

Features like saving spaces are available for customers to separate their money into different pots.

“Engine provides a best-in-class platform that fits into our digital strategy and we were impressed by Engine’s success with Starling Bank in the UK.”

Gabriela Nistor

CEO of Salt Bank

Seamless digital experiences.

Salt had a clear vision for the bank and wanted to achieve its ambitions within a 12 month project timeline. This included a mobile banking app and the back office capabilities and integrations needed to run the bank. On launch, Salt is able to offer an impressive product and feature set for customers.

Engine was selected as Salt’s core banking provider, tasked with delivering the cloud-native platform that would allow the bank to stand up their new digital proposition and customer experience. We worked closely with Salt’s team of in-house experts from the discovery stage of the project right the way through to delivery. We localised and configured the platform to meet regulatory and market requirements, while employing collaborative processes, such as embedding our team in Bucharest, to ensure rapid and efficient product testing and deployment, real-time decision making and effective planning through each phase of the project.

At launch, Salt offers transaction accounts in local and 16 foreign currencies for retail customers with automated digital onboarding supported by a manual review workflow in Engine for marginal cases. Customers have access to innovative, self-serve banking features like saving spaces, spending insights, card controls, and Apple and Google Pay in-app provisioning. This is as well as a Platinum Debit Mastercard which offers a secure, seamless and trusted payment experience. These cards are available for early adopters, or as Salt calls them ‘Founders,’ and unlock special benefits such as travel insurance for Founders and their families and local airport lounge access.

Much like Starling, Salt has also chosen to retain human touchpoints for customer service, with 24/7 support available via real agents in a dedicated Care Centre leveraging Engine’s contact centre capability and single customer view.

For launch, Salt employed a pre-enrollment program for customers to gain early access as Founders with 80,000 enrolled before public launch. This has helped propel Salt to being the top finance app listed on Apple and Google Play stores in Romania.

Salt’s early adopters will receive a Platinum Debit Mastercard.

Operational excellence.

From the customer experience to the back office, Salt has also put the employee experience at the heart of the new bank. They wanted to give the teams running operations, from financial crime and customer support to payment and card operations, the best possible processes and workflows that would empower them in their roles and help deliver the service excellence envisioned in an efficient manner.

Salt used Engine’s dedicated Management Portal to achieve this, which provides teams with a single view of the customer. Our platform’s pre-configured modules work in harmony across each functional area and with the mobile workflows on the customer end, meaning Salt can achieve the employee experience they want while observing operational efficiencies and cost savings.

Support is vital in any partnership, and Engine is providing a 24/7 Managed Service to Salt. This involves hosting and environment management, maintenance, incident management, a dedicated Client Service Desk in addition to regular upgrades, and feature and product releases.

Collaborating for success.

It was important to Salt that the bank was cloud-native and so AWS was the cloud provider chosen for the project. Engine has extensive experience working with AWS through the development and running of Starling, and the provider’s proven ability to enhance availability and agility, enable rapid development and maintain high security was essential for Salt’s comprehensive cloud strategy.

Salt also brought in the expertise of the technology consultancy firm GFT as the key implementation partner. We partnered with their engineering and technical teams as well as Salt’s in-house capability to deliver the mobile banking app and the integrations needed to ensure all systems worked seamlessly.

It is an exciting time for Salt and the public launch in April 2024 is an important milestone. Here at Engine, we’re looking forward to working closely with the Salt team over the coming months and years as they achieve their ambitions of providing Romanian customers a smarter way to bank.

CEO View

In conversation with Gabriela Nistor

In the weeks following Salt Bank’s successful launch as Romania’s first digitally native bank, Salt Bank CEO Gabriela Nistor took a quick break to answer some Q&As and tell us a little about her vision for the innovative neobank and experience of working with us.

Gabriela Nistor – CEO, Salt Bank

Salt Bank is already one of the fastest growing neobanks in Southeastern Europe. We know you had high expectations, but did the scale of the response surprise even you?

We were expecting around 20,000 sign-ups during the pre-enrolment stage and to grow after that, but we had more than 80,000 sign-ups in 3 weeks. Sometimes I had nightmares that no one would download the app at all. But after the pre-enrollment stage, when we went live, in less than 2 weeks though, we were up to 100,000 clients. We know what to do to activate them and can work quickly, so it is fine. There are other implications too, such as making sure our Care Center is working effectively because we have promised that we will be on hand to answer all their questions.

You are one of Engine’s earliest customers, is that a positive or negative?

Definitely a positive. We had big plans to build a beautiful app to disrupt the Romanian banking market and knew that you would put in the effort to make us a success, because that would be your success too. There were also other reasons for choosing Engine. We’d seen proposals from a number of potential partners by the time we got in touch. All of them were quite right, but when we heard the presentation from the Engine team though, something just clicked. You fitted our style and way of working.

Salt Bank was built in 12 months, which is pretty rapid by any measure. Can you describe the process from your side?

The first line of code was written last March, following a two month discovery phase and everything was built from scratch. While we were building the app, we were also working on the new brand, hiring the team, both on the technology side and for the Care Centre. As you can imagine, there were many challenges with a complex project like this. We had so many integrations and implementations to do in parallel and a lot of things had to happen really fast. It was like building a giant puzzle, where each piece had to be in the right place to see the big picture in the end. We worked fast, and very organised with the masterplan, but in a very agile way in each sub-project

On the first day, I remember saying to the team here, if this project is successful, it will be the team’s success. It will be hard work, I told them, but I hoped that the roller coaster ride we were all on would be fun too. I really wanted everyone to feel fully involved and that, if the bank grew, they would grow with it.

What were your impressions of working with the Engine team?

We kicked off with a long meeting, where we asked a lot of questions. We really needed to understand what could be done and how we’d do it. I also think it was really important that Engine understood our position and the scope of our ambitions. The relationship has continued in the same way from there. What I really appreciated was that Engine’s people were always very pragmatic and real ‘doers’, like us. When we needed something, a solution was always found very quickly. There has been a lot of travelling between Romania and the UK. During the launch week, there were a lot of the Engine team here, monitoring the systems and raising tickets if necessary. Right now, even a small incident is considered a big one, because we need to react very quickly to our new customers.

It is early days, but what do you know about the type of customers who are downloading the app?

It is broadly in line with our expectations. Our goal was to address a very different segment of the market to that of Banca Transilvania, which is the largest bank in Romania and South East Europe. I worked for 27-years at Banca Transilvania, latterly coordinating the retail side. The customer base there is much more universal. With Salt Bank, we are Romania’s first 100% digital bank and want to address the growing market of young professionals in urban areas. This is an affluent segment, and we wanted to give them a product they liked and could relate to. This is not just a banking app, but an innovative service that will help them save and invest their money.

What have you got planned next?

We have a very, very long roadmap of the services we will be adding in the future, which we will be working on with Engine. I’m looking forward to realising these developments together. Watch this space.

Gabriela Nistor – CEO, Salt Bank