Case study

AMP Bank GO

See all Case Studies

Project year:

2024

Bank type:

New Digital Proposition

Geography:

Australia

Build timeframe:

12 months

AMP is an established financial institution in Australia and New Zealand that provides over one million customers with banking, superannuation and retirement services.

The AMP team wanted to provide a seamless digital banking experience to customers and step-up for micro and small business owners in particular. 98% of Australian businesses are small businesses, they are the lifeblood of the economy and contribute around 30% of the nation’s GDP. But for too many years they have lacked the service and support needed when it comes to banking. AMP is changing this. Now these customers have a mobile-first bank, AMP Bank GO, with 24/7 support, that's been designed and built with their needs in mind.

By partnering with Engine, AMP has been able to realise their ambition with the public launch of their mobile app in February 2025, available to personal and business customers.

“Working with Engine enables us to equip small businesses with the best digital tools to help them manage their finances efficiently and conveniently on their mobile phone whilst on the go.”

Sean O’Malley CEO - AMP Bank GO

Creating tomorrow.

From the rainy streets of London to the sunny beaches of Sydney, our journey with AMP had a relatively simple origin; a shared vision for better banking. Back in 2022, our CEO, Sam Everington, and Chief Product Officer, Victoria Newton, as well as our partners PwC, travelled to Australia as part of a series of market trips to explore appetite for our banking technology. They were joined by Starling Bank founder, Anne Boden, who was able to bring to life her inspiring story of reinventing banking in the UK (and arguably the world) through the highly successful digital bank.

In one of many productive meetings with Sean O’Malley, AMP Bank GO CEO, and his team, the opportunity to mirror the impact that Starling was having on the small business banking market in the UK - in Australia - was clear. The markets are very similar with a few, large incumbent banks dominating the landscape, and a tech-savvy population. The AMP team saw the vision; Starling has captured almost 10% of the UK SME market, serving over 500,000 business customers. The bank was a pioneer of mobile-first banking addressing a need for seamless solutions that business owners previously lacked.

PwC played an integral role in defining the path to success, being a trusted partner of both AMP and Starling. All parties knew that embracing digital was the answer, and there was an instant connection and shared understanding of what was possible. AMP was also the right partner to take this on. Headquartered in Sydney, and featuring prominently in the city skyline, AMP has been supporting customers for over 170 years and has never been afraid of embracing new approaches. The plan was then set to design and build a new digital bank, in just 12 months, for personal and business customers that would make use of the best-in-class banking platform that underpinned Starling - Engine. The AMP team also knew that it wasn’t just the technology that they wanted to adopt, but also the ways of working and lightweight operating model spearheaded by Starling.

Work commenced in October 2023, and by staying committed to adopting proven technology and processes, AMP was able to stand up an entirely new cloud-native system; with all the capabilities and integrations needed to run the bank, as well as develop a rich customer proposition in a rapid timeframe. Launch to all AMP staff as well as friends and family was achieved in just 12 months, with go-live in October 2024.

In February 2025, the mobile app was made available to the public, a huge achievement for the teams working on the project and the product of months of work designing a digital proposition that would be a real step-change in service and support.

Becoming Australia's best digital bank.

With a market full of tech-savvy retail customers, time-poor small business owners and constantly on-the-go ‘tradies,’ the AMP team focused on delivering an effortless, mobile-first experience with features that would save time, provide insights and give customers control.

Small business owners in particular are in desperate need of something better. For years they have been dealing with poorly designed banking systems, a lack of integrated digital tools and limited after-hours support. Plus, the products on offer simply didn’t align with the realities of running a small business. AMP was determined to respond to this with a simple, powerful proposition.

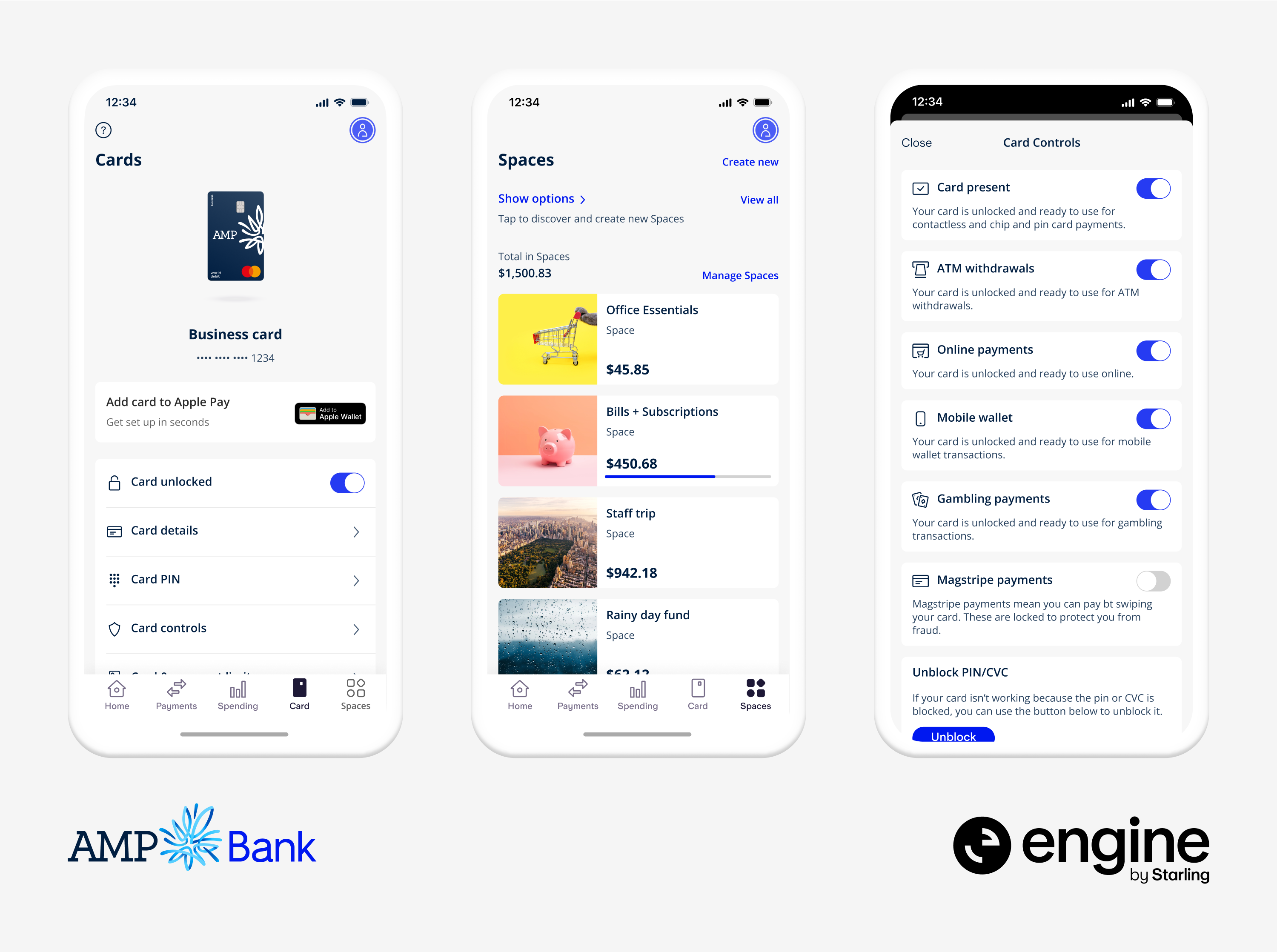

At launch, AMP Bank GO offers transaction accounts with fully digital onboarding for personal and business customers, and a host of smart, self-serve money management features. These include spending insights, card controls and savings Spaces which have round-ups, automatic transfers and savings targets.

Customers also have access to instant customer support via in-app chat and email 24/7, an aspect the team knew would be appreciated by busy business owners who often do their banking ‘after hours’. Alongside Apple and Google Pay in-app provisioning, AMP Bank GO has made the innovative move, in partnership with Mastercard, to make their debit cards numberless which means the 16-digit number does not appear anywhere on the card. This provides greater security for customers and is a market-first for business banking in Australia. The cards will enable transactions across more than 150 million merchants worldwide.

AMP’s goal is to deliver a best-in-class digital experience that directly responds to customer needs, and in partnership with Engine, this rich offering on launch is just the start.

Partnership in practice.

Implementing the programme was a feat of collaboration, enthusiasm and determination, not least because of the challenge of distance and timezones. Teams from Engine, PwC and AMP were united by the same end-goal of getting this exciting proposition into customers’ hands as fast as possible, and so from the beginning an agile methodology was taken.

Implementation was broken down into six, eight week Program Increments (PIs) - each with specific deliverables. These increments were further split into 2 weeks sprints to allow teams to rapidly resolve concerns and follow a fast and incremental rollout strategy. Perhaps most importantly, at the end of each sprint key elements were demo’ed directly to AMP (including leadership) so that testing and refinements could be made and progress felt real and tangible. This same ‘test, learn, iterate’ approach has been used throughout the launch phases and will continue to be the case as the AMP team constantly learns from customer feedback.

As the core technology provider, we knew it was essential to have a team on the ground in Sydney, as well as regular meetings with teams in the UK. Our responsibility was to build the mobile app and localise the platform for the Australian market. This included integrating Engine with local payment rails, identity and screening checks for customer onboarding, and AMP's enterprise systems. But the partnership was much deeper than that. We had to ensure that we could consistently share knowledge with AMP on key ways of working, the cultural considerations of a new way of operating and maximising the platform’s capabilities based on learnings from Starling - the how and the why. This empowered AMP to put the employee experience at the heart of the bank. A particular focus was given to training staff on Engine’s Management Portal, the single, operational system that hosts all the bank’s operations, from onboarding, cards and AML to disputes and customer support. AMP saw the value this would provide employees and the positive impact it would have for customer service.

PwC played a key role throughout, supporting AMP right across the programme. From early discovery to launch, the PwC team provided the business and market insights needed to shape the strategy and bring the business plan together. The programme was more than just delivering a digital bank, it was about reinventing the business model - ensuring AMP could fundamentally serve customers in new and better ways.

PwC led coordination and planning throughout the programme while developing, alongside Engine and AMP teams, the integration and data capabilities that seamlessly connect Engine’s core platform, AMP’s mobile-first experience, and a suite of leading technology solutions for the Australian market.

Ensuring everything was built on a cloud-native foundation was also essential, and so AWS was the cloud provider chosen for the programme. Engine and PwC have extensive experience working with AWS through the development and running of Starling, and the provider’s proven ability to enhance availability and agility as well as enable rapid development.

It is an exciting time for AMP, and here at Engine we’re looking forward to working closely with the team as we roll out even more features and capabilities - including integrations to accounting software for business customers. There is a lot more to follow, and we’re committed to helping AMP become Australia’s best digital bank.

Go to AMP Bank GO's website for more.